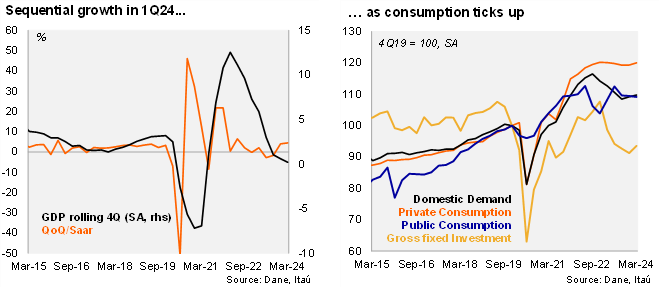

The Colombian economy grew broadly in line with market expectations during the first quarter of the year. Activity increased 0.7% YoY in 1Q24 (+0.3% in 4Q23), above BanRep’s 0.3% YoY forecast, but in line with the Bloomberg market consensus of +0.8%; and near our +1.0% call. The annual GDP increase was boosted by net exports, while private consumption gradually picked up. Sequentially, the economy rose 1.1% (SA) from 4Q23 to 1Q24, building on the previous gain of 1.0%, primarily lifted by entertainment, public administration, and agriculture. Gross fixed investment remains weak, but activity levels increased for the first time since 4Q22. Overall, the GDP breakdown does not signal significant domestic demand pressures on inflation and hence, beyond supply shocks, the disinflation process towards our 5.2% yearend CPI call remains likely.

Agriculture, public administration and entertainment pulled activity up in 1Q24, while the manufacturing drag grew. Agriculture rose 5.5% YoY (+5.3% in 4Q23), public administration increased 5.3% YoY (+5.4% YoY in 4Q23) and entertainment gained +5.2% (-1.6% in 4Q23). On the other hand, manufacturing fell 5.9% YoY (-5.3% in 4Q23) and insurance and financial activities dropped 3.0% YoY (+5.4% in 4Q23). Construction posted a mild increase of 0.7% annual increase (-2.1% YoY in 4Q23). Overall, natural resource sectors rose 2.7% YoY (+3.1% in 4Q23), while non-natural resource activity increased 0.4% YoY (+0.02% previously).

Private consumption returned to growth, while the annual investment decline moderated. Gross fixed investment contracted 6.5%, milder than the 14.1% fall in 4Q23, pulled down again by the double-digit machinery and equipment drop. Total consumption grew 0.4% YoY (0% in 4Q23), lifted by private consumption growth of 0.6% (-0.8% in 4Q23). Exports were broadly flat over one year, while imports continue to decline at a double-digit annual rate.

At the margin, activity increased 4.4% qoq/saar, similar to the 4.0% in 4Q23. The seasonal and calendar adjusted series shows that gross fixed investment increased +10.5% qoq/saar (above from the -6.1% in the 4Q23), but levels remain 13% below that of 4Q22. Private consumption grew 2.3% qoq/saar (+0.2% qoq/saar in 4Q23). Nevertheless, uncertainty around the strength of the economic recovery persists as imports shrunk 18.65% qoq/saar. The monthly coincident activity indicator (ISE) fell by 0.8% from February to March (SA), and follows a 0.3% drop in February, reflecting the fragility of the economic recovery as inflation, sentiment and interest rates remain restrictive.

Our Take: While investment increased at the margin, overall dynamics remain weak. Uncertainty over reforms and restrictive monetary policy will likely prevent a swift recovery. Meanwhile, the private consumption improvement is unfolding gradually, in line with the rebalancing of the economy to consolidate the disinflation process. We expect the economy to grow 1.2% in 2024 (from 0.6% in 2023), where the lagged effect of contractionary monetary policy, along with a gradual disinflationary process should limit a more significant rebound. We expect BanRep to continue with a 50-bp cut at the next monetary policy meeting in June, however, if the disinflation process accelerates and inflation expectations trend closer to the target, pressure would build to accelerate the cutting cycle.