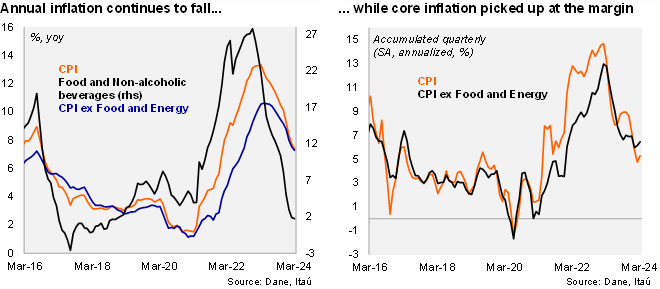

Inflation in March was broadly in line with market expectations, while somewhat above our call. Consumer prices increased by 0.70% from February to March (1.05% in March 2023), in line with the Bloomberg market consensus of 0.68%, but above our 0.57% call. The main positive contributors in the month were housing and utilities (+0.83% MoM, +26bps), transport (+1.14% MoM, +15bps) and food prices (+0.75%; +14 bps, pressured by the effect of El Niño phenomenon). Transport prices explained most of the surprise relative to our forecast. Consumer prices excluding food rose 0.69% MoM, while inflation excluding food and energy price rose by the same 0.69% (core; 0.95% one year earlier). Overall, annual headline inflation fell to 7.36% (from 7.74% in February), while core inflation declined from 7.59% to 7.32% (10.60% peak in April last year). Although there are still some upside risks to inflation from El Niño and indexation pressures, the disinflation process continues as domestic demand softens, along with falling inflation expectations.

Core inflation continued to fall, but services inflation remains sticky. Non-durable goods inflation (mainly food) came in at 7.3% YoY, falling by 76bps from the previous month. Meanwhile, even though reservoir levels remained low, energy inflation continued to fall to 23.68% YoY, a drop of 226bps from February. Durable goods inflation remained in negative territory, deepening from -0.42% in February to -2.0% in March (16.8% peak in January 2023), likely dragged by the favorable pass-through from the strong COP and weakened domestic demand. Core inflation decreased by 27bps to 7.32%, but services remained elevated, and broadly stable at 8.58% (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter was 5.3% (SA, annualized), decelerating from 7.2% in 4Q23. Meanwhile, core inflation reached 6.4% (SA, annualized, +6.9% in 4Q23).

Our take: Although energy price risks due to the El Niño phenomenon remain, along with indexation pressures, especially in services prices, favorable FX dynamics, contained food prices along with a weakening of domestic demand, point to a continuation of the disinflationary process. Our preliminary estimate for April’s CPI, to be released on May 8, is between 0.5% and 0.6% MoM, leading annual inflation to fall close to 7.0%. We expect BanRep to maintain its 50-bp easing pace in the next two meetings (April 30 and June 28) and to reach a yearend rate of 8.25%.