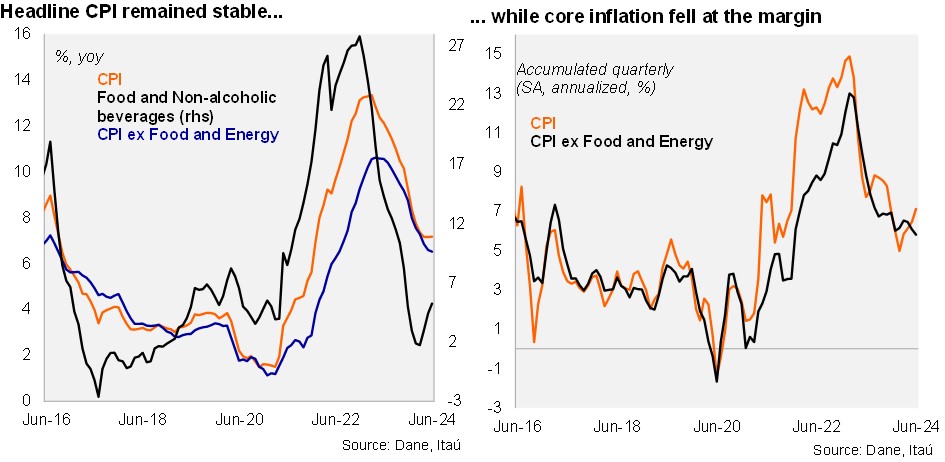

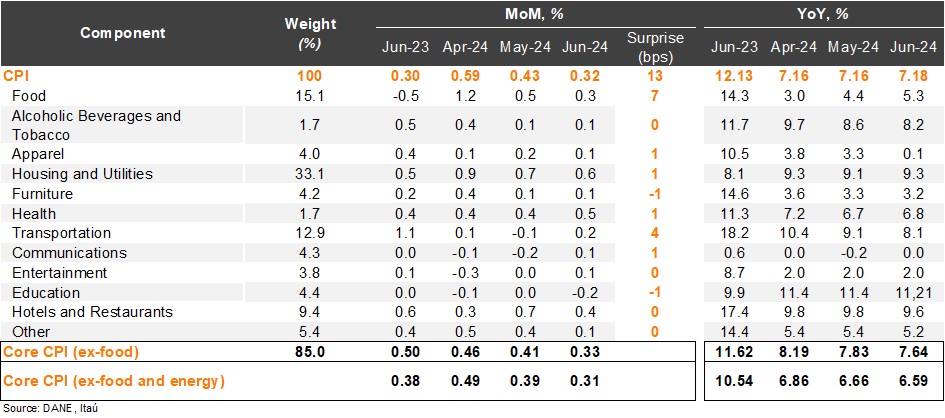

Consumer prices rose by 0.32% from May to June, in line with the Bloomberg market consensus of 0.31%, but above our 0.19% call. The main positive contributors in the month were housing and utilities (+0.58% MoM, +18bps), food (+0.3% MoM, +6bps) and hotels and restaurants (+0.4% MoM, +4bps). Food prices explained most of the surprise relative to our forecast. Consumer prices excluding food rose 0.33% MoM, while inflation excluding food and energy rose by 0.31% MoM (core; 0.38% one year earlier). Overall, annual headline inflation increased 2bps to 7.18%, while core inflation declined moderately from 6.66% to 6.59% (10.60% peak in April last year). Inflation remains elevated and the disinflation process has been gradual, while medium-term inflation expectations are still well above target.

Food prices surprised to the upside, while durable goods inflation continued to fall. Non-durable goods inflation (mainly food) came in at 7.84% YoY, increasing by 22bps from the previous month. Meanwhile, energy inflation fell to 18.35%, a drop of 135bps from May. Durable goods inflation remained in negative territory, falling from -4.36% to -4.78% in June (16.8% peak in January 2023), dragged by a weakening domestic demand. Services fell 5bps, remaining elevated at 8.23% (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter was 7.1% (SA, annualized; 5.9% in 1Q24). Core inflation moderated to 5.8% from 6.5% in 1Q24 (SA annualized, +7.0% in 4Q23).

Our take: June’s print confirms the gradual nature of the disinflation path back to BanRep’s 3% target, which put together with above target inflation expectations, limit the Board from accelerating the pace of rate cuts in the near term. Our preliminary estimate for July’s CPI, to be released on August 8, is between 0.2% and 0.3%, resulting in annual inflation falling to 6.9%. Risks to our 5.2% year-end inflation call are tilted to the upside, amid sticky services inflation and the effects of recent COP weakness. We estimate BanRep to continue with the cautious 50 bp rate cut pace at the July 31 monetary policy meeting.