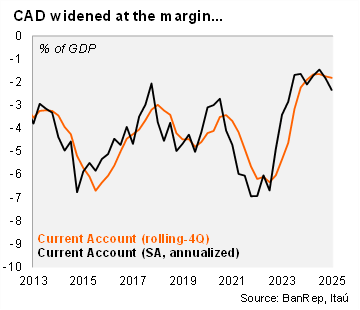

The recovery of domestic demand was reflected in a gradually widening of the CAD. A USD 2.3 billion current account deficit was registered in the first quarter of the year, 2.2% of GDP, USD 0.3 billion larger than in 1Q24. A wider trade deficit explained the increase but was restrained by higher transfers. The deficit was smaller than the Bloomberg market consensus of USD 2.5 billion and our USD 2.7 billion call. As a result, the rolling-4Q current account deficit increased by 0.1pp from 4Q24 to 1.8% of GDP (USD 7.6 billion). At the margin, our own seasonal adjustment shows the annualized deficit sits at 2.3% of GDP in 1Q25, 0.5pp wider than in 4Q24.

The larger current account deficit was mainly explained by a 52% YoY increase in the trade balance deficit (USD2.9 billion; 2.8% of GDP). The trade balance of goods came out at 3.1 billion deficit (3.0% of GDP). Exports of goods increased 3.4% YoY during 1Q25 (+0.2% in 4Q24), but imports grew more swiftly (+10%; +6.4% in 4Q24). The services trade balance posted a USD 0.15 billion surplus. The overall widening of the trade deficit was partially offset by a 15% rise in transfers (USD3.8 billion; 4.0% of GDP) and a 4.5% income deficit decrease from 1Q24 (3.3% of GDP), amid low oil prices. The 15.8% YoY increase in remittance inflows to USD3 billion remains a highlight. The rolling four-quarter figure reached a record high of USD 11.9 billion (2.8% of GDP). If remittances were excluded, the rolling-4Q CAD would have stood at 4.9% of GDP.

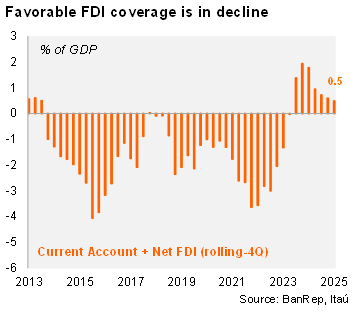

Although foreign direct investment declined in 1Q25, it continues to finance Colombia’s external imbalance entirely. Direct investment into Colombia totalled USD 3.1 billion in the first quarter of 2025 (3.2% of GDP), which is USD 0.5 billion (or 15%) lower than in the first quarter of 2024. Net direct investment reached USD 2.5 billion in the quarter (2.4% of GDP), and USD 9.6 billion over the rolling four-quarter period (2.3% of GDP). Overall, net direct investment posted 107% coverage of the CAD, down from recent periods. Finally, foreign portfolio investments in Colombia recorded a USD1.2 billion inflow during 1Q25 (1.2% of GDP), while residents in Colombia increased their assets abroad sharply by USD2.8 billion (2.9% of GDP), 53% yoy more than in 1Q24.

Our Take: We expect the current account deficit to reach 2.6% of GDP this year (1.8% of GDP in 2024), as domestic demand recovers. Upbeat transfers pose a downside risk.