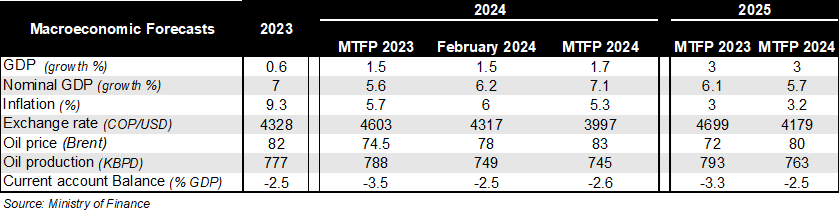

Medium-term fiscal challenges persist. The Ministry of Finance’s medium-term fiscal framework outlined the challenging fiscal consolidation path, in the context of revenue disappointments this year. The MoF revised 2024 GDP growth up 0.2pp to 1.7% (Itau: 1.2%), and then 3% for 2025, unchanged with respect to the previous report (Itaú: 2.6%). The medium-term growth forecast remained unchanged at 3.2%. Inflation for the yearend was revised down by 0.7pp to 5.3% (Itaú: 5.2%) and then to 3.2% by 2025. Meanwhile, the oil price forecast increased to USD 83 from USD 78 in the February forecast. In addition, a lower-than expected exchange rate (COP 3997; .7% lower than the February fiscal plan) would contribute to contain the interest payments on the external debt. Thus net debt is seen rising to the 55% of GDP anchor this year (from 53.8% in 2023), but narrowing 1.7pp from the previous estimation, before peaking at nearly 57% in 2027.

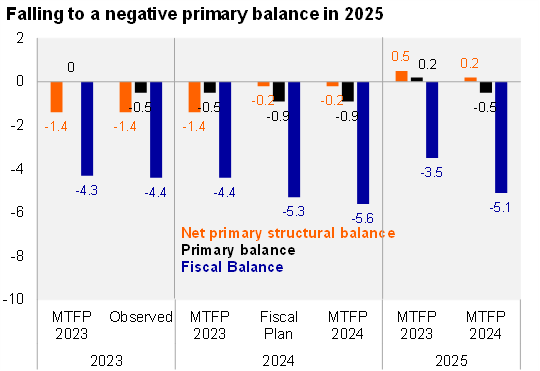

Lower revenues lead to higher fiscal deficits, despite spending cuts. In line with weak tax collection to date (4.4% YoY nominal contraction as of May), the ministry revised 2024 revenue forecasts down by around 10% (COP 31 trillion; around 2.0% of GDP), and signaled spending cuts of about COP 20 trillion (around 1% of GDP), nearly evenly split between regular spending and investment. Certain expenditure controls are considered to lead to COP 10 trillion in savings (about 0.6% of GDP). Accordingly, the nominal fiscal deficit was raised by 0.3pp to 5.6% of GDP (4.3% in 2023), while the 2024 primary deficit rose to 0.9% of GDP (0.3% of GDP in 2023). The expected fiscal shortfall remains coherent with the fiscal rule, with 0.2pp in the GDP gap, and another 0.2pp in the oil gap.

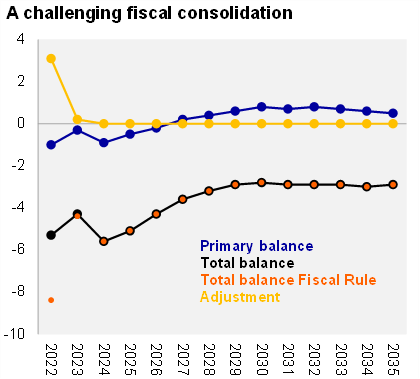

Adjustments to the fiscal rule on the table. The nominal fiscal deficit is seen gradually narrowing to 5.1% of GDP in 2025 (primary: -0.5% of GDP), amid higher tax revenues at 16.2% of GDP (15.3% expected to 2024). However, a higher fiscal deficit implies abandoning the transitional regime of the rule and moving to a parametric regime, which would require congressional approval in the second half of the year. Such a change to the Fiscal Rule would provide additional fiscal space of 0.3% of GDP in 2025. A primary surplus of 0.2% of GDP is seen materializing in 2027. A primary fiscal surplus average of 0.6% between 2028 and 2035 is assumed in the outlook.

Gradual reduction of diesel subsidies. In 2024, the Fuel Price Stabilization Fund (FPEF) would reach 1.2% of GDP (previously estimated at 0.6% of GDP), while the government announced the reduction of the diesel subsidy for large contributors, with an estimated fiscal impact of 0.4% of GDP. In 2023, the FPEF will accumulate a net position of 1.7% of GDP (COP 20.5 trillion, of which COP 15.2 billion corresponds to diesel 74%). Although the gap between local and international fuel prices has narrowed, next year the gap would be COP 5 trillion.

Higher financing needs for 2024. The Central Government's 2024 gross financing is estimated at 8.5% of GDP (COP 143 trillion, 12 trillion above the previous estimate), with interest payments rising to 4.7% of GDP (3.5% in 2023; 66.2% of the total financing) and amortizations declining to 1.5% of GDP (1.8% estimated the previous update). Regarding financing via capital markets, the government is expected to seek financing for COP 87.3 trillion in 2024 (5.2% of GDP), above from the COP 75,8 trillion expected in February (4.5% of GDP). Domestic funding would reach COP 63.7 trillion, covered by auctions of local currency debt for COP 40 trillion (increasing COP 3 trillion from February estimated), and other funding sources for COP 23.7 trillion, including COP 1.0 trillion in green bonds and COP 7 trillion in bonds for pay the FPEF debt to Ecopetrol (which could pay dividends with these bonds).

Targeted financing mix with less pressure on external financing. The government now targets USD 5.7 billion in external financing, up USD 0.2 billion from the previous estimate, of which 56% will be sourced from loans with international financial institutions. The remaining needs are projected to be sourced from debt issuance in international capital markets. Thus, the targeted financing mix is 73% in local currency, and 27% in foreign currency, relying more on the local market with compared to the February fiscal plan (70/30 split).

Our take: The official forecasts reflect Colombia’s challenging fiscal outlook, as anticipated by the persistent revenue disappointments this year and in the context of low liquid buffers. Even though the MoF under executed the 2023 budget by COP 7 trillion, this year’s spending cuts seem particularly ambitious, as a slow recovery suggests revenues may take longer to pick up. The Fiscal Council recently highlighted that the economy must return to trend growth to achieve the proposed fiscal consolidation. The challenges facing the fiscal consolidation process are in line with the recent negative outlook revision by S&P on the 'BB+' rating, while Fitch recently warned of possible fiscal target miss. Colombia is rated as non-investment grade by S&P and Fitch, while Moody’s maintains Colombia's investment grade rating at Baa2 (outlook stable). With political support in Congress fraying, the proposed fiscal rule modification be challenging, and some negative credit rating announcement seems likely ahead. Finally, the central bank’s cutting pace will likely continue to be gradual amid the challenging domestic fiscal scenario.