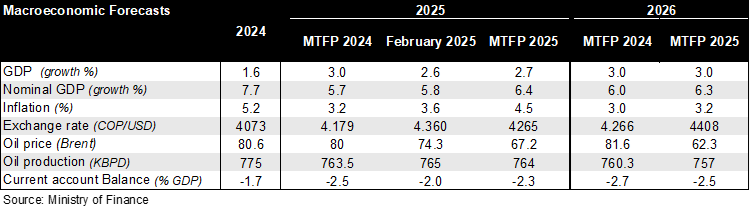

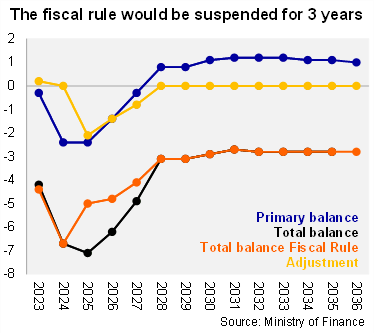

The recent update to estimates reflect the challenging fiscal outlook for Colombia. With the activation of the escape clause, the fiscal rule was suspended for 2025, 2026 and 2027, permitting larger fiscal deficits and further denting Colombia's fiscal credibility. The main argument for the activation of the escape clause is the likelihood of a government shutdown given that 86% of the total spending is inflexible, while current revenue dynamics have underperformed. Returning to the planned fiscal consolidation path will be a three-year ordeal that incorporates a new tax reform (1% of the GDP). The MoF revised the 2025 GDP growth forecast up 10bps from February's scenario to 2.7% (Itaú: 2.5%), while retaining the 3% for 2026 (Itaú: 2.5%). The medium-term growth forecast was set at 2.9%. Inflation for this year was revised up by 0.9pp to 4.5% (Itaú: 5.1%) and 3.2% by YE26. Meanwhile, the oil price forecast fell to USD 67.2 from USD 74 in February’s forecast. A stronger exchange rate (COP 4,265; 2.2% stronger than the February fiscal plan) would help contain interest payments on external debt. Overall, net debt is seen rising to 61.3% of GDP this year, above from the 55% of GDP anchor, and the 59.3% in 2024. For 2026, net debt will reach 63% of GDP, and thereafter gradually converge to 61% by 2036.

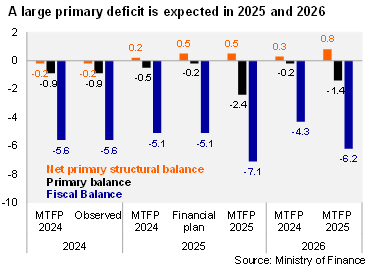

Lower tax revenues and higher primary spending driver larger fiscal deficit. Despite the improvement in tax collection year-to-date (+10% YoY nominal expansion to April), it remains well below the February Fiscal Plan estimate of +22%. The MoF revised the revenue forecast down by COP 18.5 trillion (1.0% of GDP), to an expected annual growth of 14.9%. This new estimate includes 0.4% of GDP from the advance payment of the2026 withholding tax to 2025. Accordingly, the nominal fiscal deficit was raised up by 2pp to 7.1% of GDP (+6.7% in 2024), with a primary deficit of 2.4% of GDP (+0.2% expected in the MTFF 2024). The primary deficit is far higher than the fiscal rule of 0.3% of GDP in 2025. In 2025, the Fuel Price Stabilization Fund (FPEF) would reach 0.4% of GDP (null impact estimated in the previous financial plan). In 2024, the Fuel Price Stabilization Fund (FPEF) accumulated a net position of 1.2% GDP (COP 21.3 trillion). A nominal fiscal deficit of 6.2% of GDP is expected for next year (4.3% in the MTFF 2024; primary deficit of 1.4% of GDP), and down to 4.9% in 2027 (3.6% in the MTFF 2024; primary deficit of 0.3% of GDP).

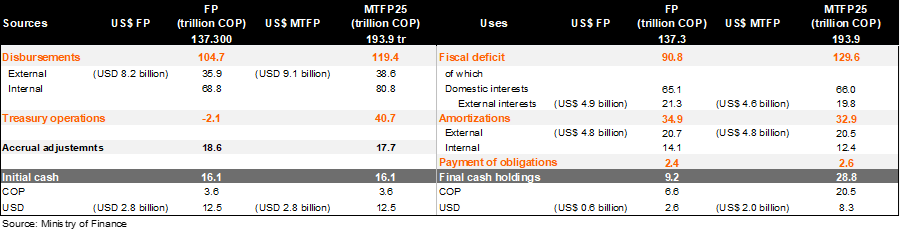

Higher financing needs in 2025, concentrated in higher short-term operations. The Central Government’s 2025 gross financing is estimated at 10.7% of GDP (COP 193.9 trillion; COP 56.6 trillion above the previous estimate), with interest payments at 4.7% of GDP (4.8% in 2024; 44% of the total financing), while amortizations decline to 1.8% of GDP (1.9% estimated in the previous update). Regarding financing via capital markets, the government is expected to seek COP 119.4 trillion in 2025 (6.6% of GDP), above from the COP 104.7 trillion expected in February (5.8% of GDP). Domestic financing would reach COP 80.8 trillion (4.4% of GDP), covered by auctions and local currency debt for COP 58 trillion (3.2% of GDP; increasing COP 13 trillion from February’s estimated), along with other funding sources for COP 22.8 trillion (1.3% of GDP), including COP 1.5 trillion in green bonds. Treasury operations also rebounded to COP 40.6 trillion from (2.2% of GDP; COP 2 trillion previously expected), including short-term COP bonds (TCO) of 0.9% of GDP and 0.7% of GDP from REPOS and short-term liquidity operations. The government reiterated the strategy to reduce debt maturity.

A broadly stable financing mix. The government now targets USD 9.1 billion in external financing (2.1% of GDP; up USD 0.9 billion from the previous estimate), 32% of total financing (February fiscal plan: 66% local, 34% foreign). The external financing is split with 34% sourced from loans with multilaterals and commercial banks (56% in February’s plan), of which USD2.1 billion would be financed through multilaterals (0.5% of GDP; USD 4.6 billion in the February’s plan) and USD 1 billion (0.2% of GDP) from commercial banks. The remaining needs are projected to be sourced from debt issuance in international capital markets for USD 6.0 billion (1.4% of GDP; 66.2% of the total; 44.3% in February’s financial plan).

OurTake: The official forecasts reflect Colombia’s challenging fiscal outlook, with persistent revenue disappointments and rigid expenditures. The challenges facing the fiscal consolidation process are in line with the revision to a negative outlook by S&P and Fitch on the 'BB+' rating. We do not discard a credit rating downgrade by Moody´s in the short term (currently at Baa2), and will be attentive to IMF statements on the suspension of the FCL. The fiscal scenario presented by the government is more realistic photo of the current situation, but highlights the need to adjust spending rigidities while seeking structurally higher revenues.