2025/09/02 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

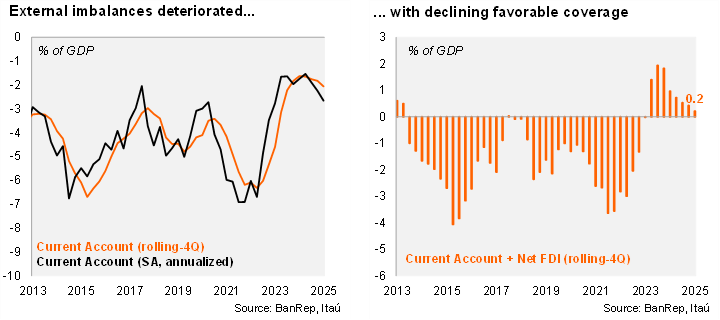

A USD 2.6 billion current account deficit was recorded in 2Q25, equivalent to 2.5% of GDP (USD 1.0 billion greater than 2Q24). The deficit was in line with the Bloomberg market consensus of USD 2.6 billion, but below our USD 2.9 billion call. Despite an increase in the goods trade deficit, strong remittance dynamics contributed to contain the CAD in 2Q25. As a result, the rolling 4Q current account deficit increased from 1Q25 by 0.2pp to 2.1% of GDP (1.8% in 2024). At the margin, our own seasonal adjustment shows the annualized deficit sits at 2.7% of GDP, 0.4pp wider than 1Q25.

The domestic demand rebound is reflected in rising imports. Exports fell 3.2% YoY during 2Q25 (+4.1% YoY in 1Q25), while imports expanded 8.2% YoY (+10.3% YoY in 1Q25). As a result, the goods trade deficit widened by USD 1.7 billion from 2Q24 to USD 3.6 billion Meanwhile, the services balance dropped USD 0.2 billion from 2Q24 to USD 0.1 billion. Transfers reached USD 4.2 billion (up USD 0.3 billion from 2Q24). The income deficit slightly narrowed to USD 3.0 billion (USD 3.1 billion in 2Q24).

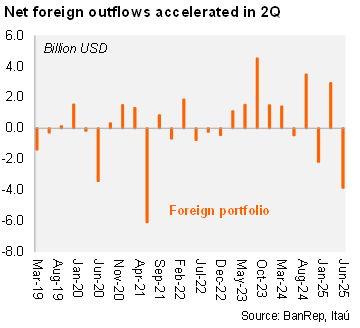

Net foreign portfolio outflows surged in Q2. Direct investment into Colombia came in at USD 3.4 billion in 2Q25, USD 0.6 billion above last year. Net direct investment reached USD 1.9 billion (a USD 0.2 rise from 2Q24), resulting in USD 9.6 billion for the rolling year, achieving a 111% coverage of the CAD (130% in 2024; 187% in 2023). Finally, foreign portfolio investments in Colombia recorded a USD 3.9 outflow during 2Q25 (a USD 0.4 billion outflow in 2Q24), the greatest since the covid era.

Our Take: We project the current account deficit to widen to 2.7% of GDP this year, up from 1.8% in 2024, mainly reflecting stronger domestic demand. Nonetheless, resilient transfer inflows may partially offset the trade deficit deterioration.