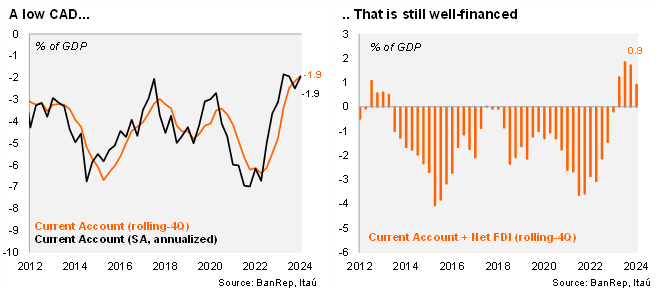

A significant narrowing of the CAD was observed in the 2Q24. A USD 1.6 billion current account deficit was registered in the second quarter of the year (narrowing USD 0.6 billion from 2Q23), equivalent to 1.6% of GDP (2.2% of GDP in 1Q24; revised to the upside from 1.9% of GDP). The deficit was well below the Bloomberg market consensus of USD 2.1 billion and our USD 2.2 billion call. A mild narrowing of the services deficit and higher transfers led to the significant narrowing of the CAD in the 2Q24. As a result, the rolling-4Q current account deficit fell to 1.9% of GDP (USD 7.8 billion) from 2.2% of GDP (USD 8.4 billion) as of March and 2.5% of GDP (USD 9.1 billion) in 2023. At the margin, our own seasonal adjustment shows the annualized deficit sits at 1.9% of GDP in 2Q24, 0.6pp down from 2.5% in 1Q24.

The USD 0.6 billion narrowing of the CAD in 2Q24 from last year was mainly due to higher transfers. Exports increased 2.6% yoy during 2Q24 recovering from 12.8% contraction in 1Q24, while imports rose by 4.2% (-10% in 1Q24). Overall, the goods trade deficit widened USD 0.3 billion from 2Q23 to USD 2.0 billion. Meanwhile, the services balance narrowed by USD 0.1 billion to USD 0.2 billion deficit, while transfers reached USD 3.9 billion (USD +0.8 billion from 2Q23). Moreover, the income deficit remained broadly stable at USD 3.3 billion from the 2Q23 (USD 4.8 peak in 3Q22).

Net direct investment fell significantly in 2Q24, while the overall financing of the CAD remains favorable. Direct investment into Colombia came in at USD 2.8 billion in 2Q24, USD 2.5 billion down over one year. Net direct investment reached USD 1.8 billion (a USD 3.6 billion drop from 2Q23), resulting in USD 11.5 billion for the rolling year, achieving a 148% coverage of the CAD (175% in 2023; 65% in 2022).

Our Take: We expect the current account deficit to close at a low 2.7% of GDP this year (2.5% in 2023), amid still weak domestic demand. Nevertheless, risks tilt to a smaller current account deficit given the surprise in 2Q24. The low CAD may moderate volatility to external shocks. Amid a low CAD, and falling inflation we expected the central bank to continue to cut rates with another 50bps adjustment at the next monetary policy meeting (September 30).