2026/01/09 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

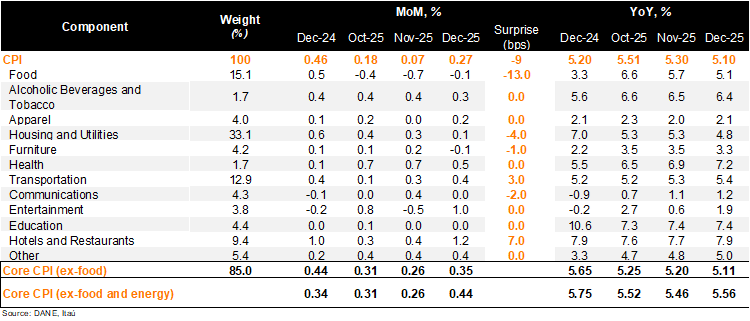

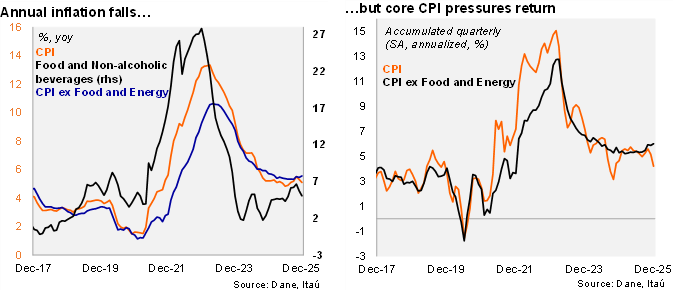

Lower-than-expected headline inflation in December; core dynamics remain unfavorable. Consumer prices rose by 0.27% MoM in December, below the Bloomberg market consensus of 0.34% and our 0.36% call. The main positive contributors in the month were hotels and restaurants (+1.24%; +14bps); transport prices (+0.41%; +5bp), and entertainment (+1.04%; +3bps). Meanwhile, food prices dropped by 0.11% MoM dragged by fruits, subtracting 2bps. Food prices explained most of the surprise relative to our forecast. Consumer prices excluding food rose by 0.35% (+0.44% one year earlier), while energy prices decreased by 0.41% MoM (+1.34% one year ago). Thus, inflation excluding food and energy increased by 0.44% MoM (+0.34% one year ago). On an annual basis, headline inflation fell by 20bps from November to 5.1% in December, which was in line with the BanRep technical staff's forecast for 2025. Meanwhile, annual core inflation increased by 10bps to 5.56%. Both measures completed six years above the target range.

Favourable food and energy CPI dynamics were offset by services inflation. Non-durable goods inflation (mainly food) came in at 4.10% YoY, falling by 76 bps from the previous month. Similarly, energy inflation decreased by 1.78 p.p. to 1.22% YoY, driven by base effects and a monthly decline in both gas and electricity prices. Amid the peso’s strengthening, durable goods fell by 16 bps to 0.47% YoY. However, services inflation increased during the month by 16bps up to 6.42% (9.51% peak in September 2023). At the margin, we estimate inflation accumulated in the quarter reached 4.2% (SA, annualized, moderating from 5.2% 3Q25). Core inflation accelerated slightly to 6.0%, up from 5.5% in 3Q25 (SA, annualized).

Our take: Following the significant minimum wage increase of 23% (18% in real terms), we expect inflation to accelerate going forward. Our preliminary estimate for January’s monthly inflation, scheduled for release on February 6, ranges between 1.1% and 1.3%, resulting in the annual CPI print increasing to 5.2%. Considering the recent developments, our inflation forecast could exceed 6% for 2026, leading us to also adjust our on-hold call for the policy rate. A hiking cycle is inevitable, likely to begin in the next monetary policy meeting on January 30, with a hike of at least 50-bps.