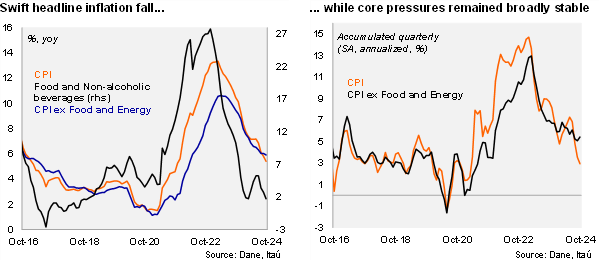

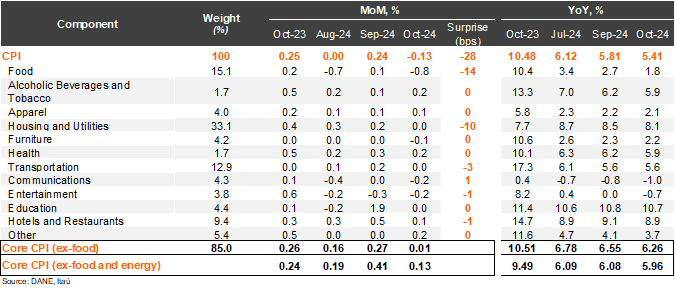

Lower food prices led to a 0.13% CPI drop from September to October, well below the Bloomberg market consensus of +0.16% and our +0.15% call. The main negative contributors in the month were food prices (-0.8% MoM; -14bps), housing and utilities (-0.04% MoM; -1bps) and entertainment (-0.17%; -1bps). Food and housing and utilities explained most of the surprise relative to our forecast. Consumer prices excluding food increased by a mild 0.01% MoM (+0.26% one year earlier), while inflation excluding food and energy rose by 0.13% (core; 0.24% one year earlier). Overall, annual headline inflation fell by 40bps from September to 5.41%, while core inflation fell by 12bps to 5.96% (10.60% peak in April last year).

Food and energy prices behind swift CPI deceleration, core dynamics remain sticky. Non-durable goods inflation (mainly food) came in at 3.8% yoy, dropping 91bps from the previous month. Meanwhile, energy inflation fell to 9.7%, a drop of 162bps from September. Durable goods inflation remained in negative territory at -4.46%. Services inflation dropped by 13bps to a still elevated 7.75% (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter was 2.9% (SA, annualized; 3.5% in 3Q24). Core inflation increased to 5.4% from 5.1% in 3Q24 (SA annualized).

Our take: While some food price payback may occur ahead, the headline disinflationary process is advancing. Our preliminary estimate for November’s CPI, to be released on December 7, is between 0.2% and 0.3%, resulting in annual inflation falling to 5.2%. Despite the downside surprise in inflation, domestic fiscal noise coupled with increased global financial volatility and still sticky core inflation sets the bar still high for BanRep to accelerate the pace of cuts at the next monetary policy meeting on December 20.