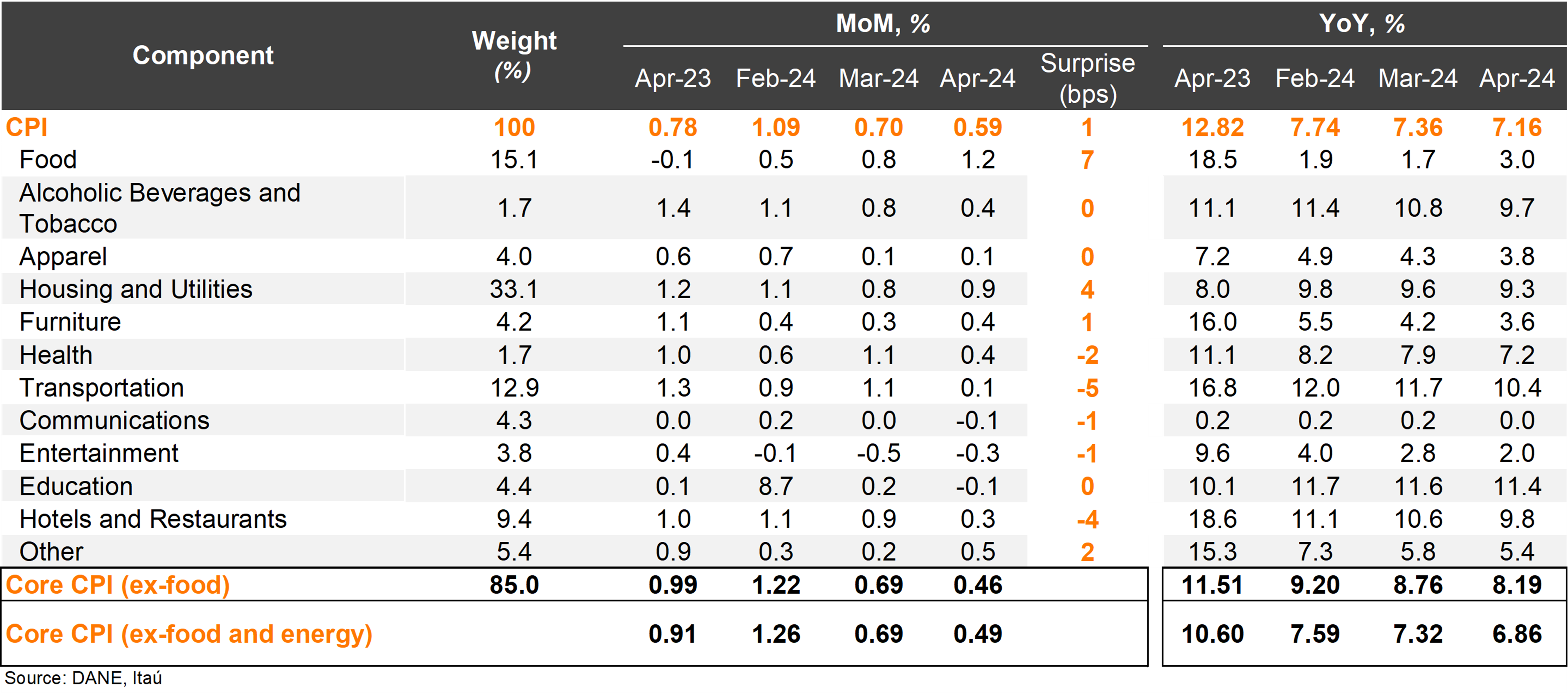

Consumer prices increased 0.59% from March to April (0.78% in April 2023), in line with the Bloomberg market consensus of 0.59% and our 0.58% call. The main positive contributors in the month were housing and utilities (+0.93% MoM, +29bps) and food prices (+1.16% MoM, +22bps). Consumer prices excluding food rose 0.46% MoM, with energy prices contributing 6bps (+1.56% MoM). Meanwhile, inflation excluding food and energy prices rose by 0.49% MoM (core; 0.91% one year earlier), lifted by rentals (+1.1% MoM, +23bps). Overall, annual headline inflation fell 20bps to 7.16%. Although headline inflation remains well above target, the disinflationary process continues to advance, with risks from the El Niño phenomenon far milder.

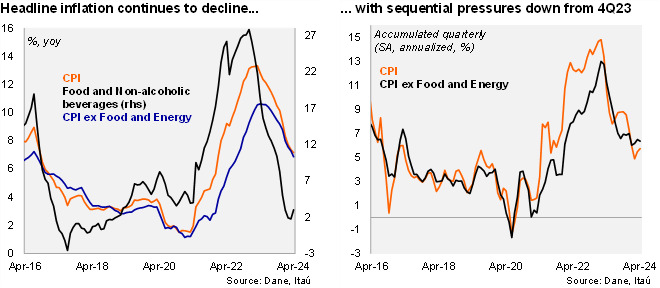

Core inflation continues to correct. Core inflation declined 46bps to 7.32% (down from the 10.60% peak in April last year). Non-durable goods inflation (mainly food) came in at 7.34% YoY, increasing by 4bps from the previous month. Meanwhile, energy inflation continued to fall to 21.87% YoY, a drop of 181bps from March. Durable goods inflation remained in negative territory, falling from -2.0% to -2.95% in April (16.8% peak in January 2023), amid favorable COP dynamics and a soft domestic demand. Service prices fell 27bps, but remain elevated at 8.31% (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter was 5.7% (SA, annualized), decelerating from 7.3% in 4Q23. Meanwhile, core inflation reached 6.4% (SA, annualized, +7.0% in 4Q23).

Our take: Our preliminary estimate for May’s CPI, to be released on June 11, is between 0.3% and 0.4%, resulting in annual inflation falling to 7.1%. We expect inflation to fall to 5.2% by yearend. We estimate BanRep to continue with the 50-bp cut pace at the next monetary policy meeting in June, amid tighter global financial conditions and growing uncertainty on the domestic fiscal front. However, the accelerating disinflation process, converging inflation expectations and weak domestic activity could build pressure to increase the rate cut pace ahead.