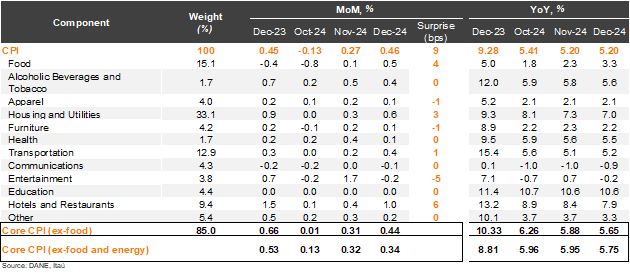

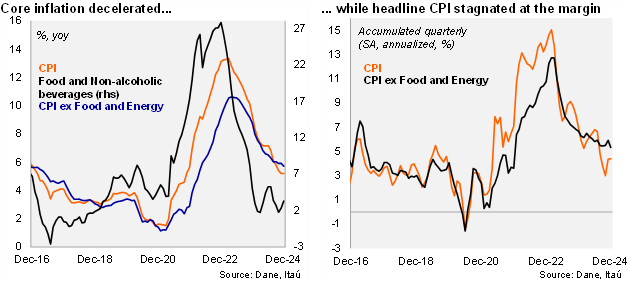

Consumer prices rose by 0.46% mom in December, above the Bloomberg market consensus of 0.42% and our 0.37% call. The main positive contributors of the month were housing and utilities (+0.58% mom; +18bps), hotels and restaurants (+0.99% mom; +11bps) and food prices (+0.53% mom; +10bps). Hotels and restaurants and food prices explained most of the surprise relative to our forecast. Consumer prices excluding food increased 0.44% mom (+0.66% mom one year earlier), while inflation excluding food and energy rose by 0.34% mom (core; 0.53% one year earlier). Overall, annual headline inflation remained stable from November at 5.2%, resulting in a total drop of 408bps in inflation throughout 2024. Meanwhile, core inflation dropped by 20bps from November to 5.75% (vs.10.60% peak in April last year; 8.8% at the end of 2023).

Durable and non-durable goods rebounded, while services prices decelerated. Non-durable goods inflation (mainly food) came in at 3.6% yoy, increasing 36 bps from the previous month. Meanwhile, energy inflation fell to 5.0%, a drop of 53bps from November. Durable goods inflation remained in negative territory at -3.1%, but increased 58bps from November. Services inflation dropped by 30bps to a still high 7.38% (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter was 4.4% (SA, annualized; 3.7% in 3Q24). Core inflation fell to 5.3% from 5.5% in 3Q24 (SA annualized).

Our take: The disinflationary process stalled in December. Our preliminary estimate for January’s CPI, to be released on February 7, is between 0.9% and 1.0%, resulting in annual inflation once more being steady at a high 5.2%. The progress of the disinflationary process will be limited by a higher-than-expected increase in the minimum wage (+9.54% nominal, +4.34% real), increasing price indexation pressures, resulting in an upside bias to our 3.7% forecast for yearend. Further indexation pressures, coupled with tighter global financial conditions, could lead the Central Bank board to maintain a cautious stance at the next MP to take place on January 31 with a small 25bp cut or even pausing.