2025/09/02 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

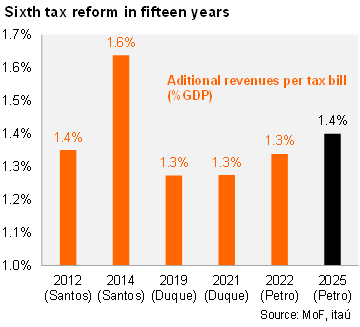

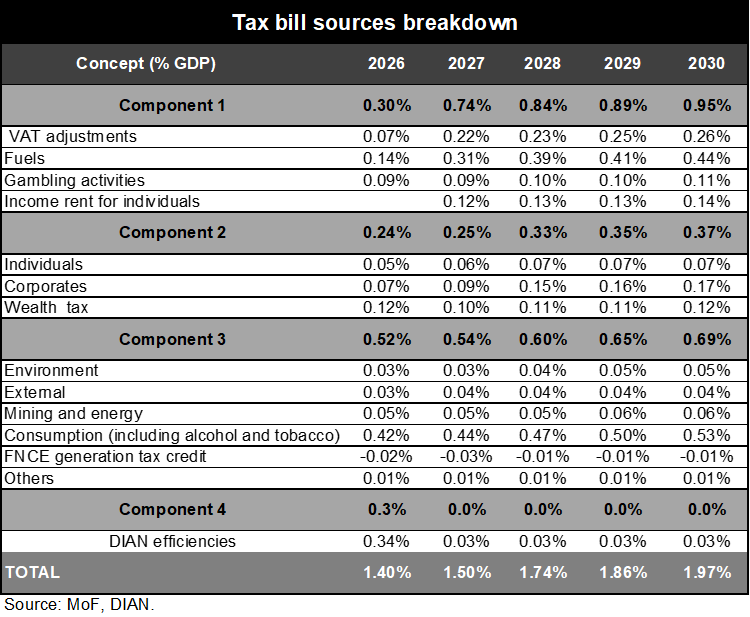

As expected, the government presented a revenue-enhancing tax reform which aims to raise an additional COP26.3 trillion (1.4% of GDP) to finance the 2026 national budget of COP557 trillion (28.9% of GDP). Excluding tax office (DIAN) efficiencies, the reform aims to raise an additional COP19.9 trillion (1% of GDP). Most of this income is projected to come from adjustments to the consumption tax, which raises resources equivalent to 0.4% of GDP and VAT adjustments that include a 10% VAT on fuels (initially on producer income from gasoline and diesel, equivalent to 0.2% of GDP), a 19% VAT on gambling activities (0.1% of GDP). We estimate that altogether VAT and consumption tax could affect at least 12% of the items in the CPI basket. For individuals, the bill proposes broadening the tax base, an even higher rate for wealth taxes (0.1% of GDP) and higher marginal income rent tax rates (0.05% of GDP). Finally, the Ministry of Finance (MoF) also establishes structural income rent surcharges for corporations (0.07% of GDP). More specifically, the text proposes a 15% surcharge for financial activities and between 0% and 15% for oil and gas companies.

More than a third of the reform (0.52% of GDP) is funded by sectoral taxes, particularly on alcoholic beverages and tobacco. To offset the impact on public health, the ad valorem component of alcoholic beverages will be set at 30%, while the specific component will be set at $1,000 per degree of alcohol per liter. Additionally, VAT on alcoholic beverages will increase from 5% to 19%, resulting in an additional tax collection of COP 7.2 trillion (0.4% of GDP). Meanwhile, the reform proposes maintaining a 10% ad valorem tax on cigarettes and introducing a 30% ad valorem tax on vaping products. It is estimated that the price of cigarettes and vaping products will increase by 57%, contributing an additional COP 1 trillion (0.05% of GDP) to tax collection. Alcoholic beverages and tobacco account for 1.7% of the CPI basket.

Environmental taxes are increasing again. The government has announced a carbon tariff ranging from 0% to 15% for oil and gas companies, depending on how much they deviate from historical international prices. A gradual implementation of the full coal tariff has been introduced, starting at 40% in 2026, increasing to 60% in 2027, 80% in 2028 and reaching 100% in 2029.

Corporate income tax rates continue to increase, adding COP 1.3 trillion (0.07% of GDP), with additional sectoral surcharges. The MoF introduced structural income tax surcharges for corporations, amounting to 0.07% of GDP. The text proposes a 15% surcharge for financial activities (5% currently), resulting in a 50% tariff (40% actually), which is now permanent. Thus, the modification eliminates the temporary surcharge defined in the 2022 financial law between 2023 and 2027.

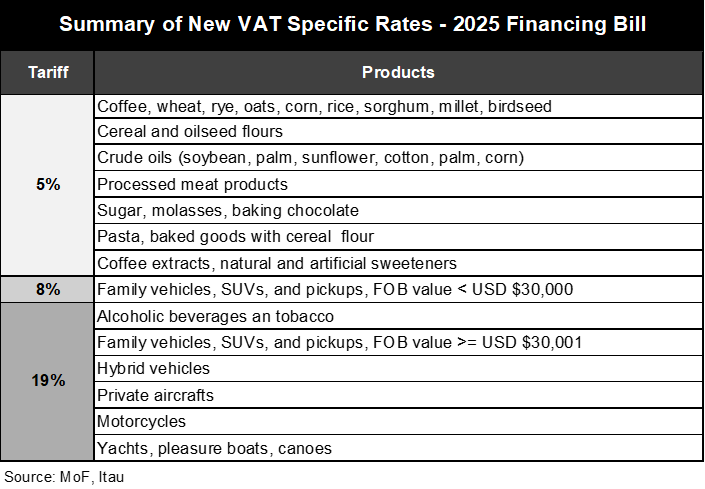

Modifications to consumption tax represent the second largest source of additional revenue (0.3% of GDP). These include a 19% levy on luxury goods and services, such as entertainment activities costing more than USD 125, including concerts and football matches, which account for 0.7% of the overall CPI basket. The MoF also plans to close the gap between the maximum VAT rate (currently 19%) and the consumption tax rate (currently 16%). Finally, low-cost imports with order values of less than USD 200 will also be affected.

VAT adjustments are also intended to increase revenue by 0.07% of GDP in 2026 and 0.3% by 2030. Although the MoF does not initially intend to impact on the basic household consumption basket, the reform introduces a 5% VAT on essential agro-industrial inputs and food products (e.g. coffee, cooking oil and wheat). This could lead to inflationary pressures, given that these items account for 3.9% of CPI. According to the text, vehicles (accounting for 2.7% of the CPI) with a price below USD 30,000 will be subject to an 8% VAT, whilst hybrid vehicles or more expensive cars will be subject to a 19% VAT. Furthermore, the reform introduces 10% VAT on fuel, initially targeting producer income from gasoline and diesel in 2026, which is expected to raise 0.2% of GDP. Diesel will be charged at COP432 per gallon, gasoline at COP384 per gallon, and natural gas at COP83 per cubic meter. These changes are intended to support the energy transition, but they could also lead to inflationary pressures. It should be noted that fuel and gas account for 2.8% and 1.0% of the overall CPI, respectively.

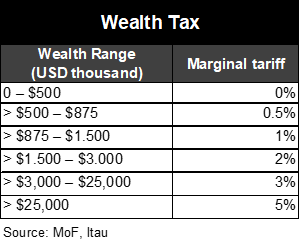

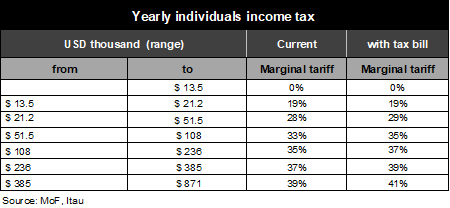

For individuals, the MoF proposes broadening the tax base and introducing a higher wealth tax rate (0.1% of GDP), as well as higher marginal income tax rates, which aim to raise revenues by 0.05% of GDP. According to the reform, individuals will also face increased marginal income tax rates on wages above USD 13.5 thousand per year, with the current brackets increasing by 2 percentage points to a maximum income tax rate of 41% (compared to 39% currently). The reform also removes the exemptions for dependants and increases the tax rate on windfall gains by up to 30% (currently 20% for lotteries and gambling). Regarding the wealth tax, the bill proposes widening the tax base to USD 500 thousand (from USD 900 thousand) and introducing higher marginal wealth tax rates, which aim to raise 0.1% of GDP. Marginal wealth tax rates have also been adjusted, with the maximum rate increasing to 5% (currently 1.5%). Finally, the tax rate on dividends is set to rise from 20% to 30% for foreigners.

The bill considers important revenue gains from greater tax efficiencies (COP 6 trillion, or 23% of the total). The project proposes a 15% tax on undeclared assets, and alongside the strengthening of the tax agency (DIAN) and the regulation of digital assets, the Ministry of Finance (MoF) expects to raise revenues equivalent to 0.4% of GDP by 2026 (0.03% of GDP from 2027 onwards).

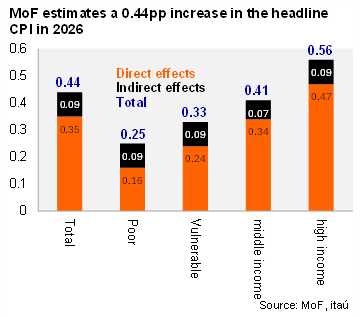

Official forecasts consider only minor macroeconomic effects from the reform. The government estimates the net effect on growth to be 0.2 percentage points (pp) in GDP and 0.6 pp in investment between 2026 and 2036. It also estimates an inflationary impact of 44bps (35bps of which will be direct) from VAT and consumption tax in 2026 alone..

There is a tight legislative agenda. Discussions on the tax bill in Congress will run alongside the definition of the budget amount, with approval required by September 15. The first debate on the breakdown of expenditure will take place on 25 September, with a budget approval deadline on October 20 . As it did one year ago, otherwise the approval of the 2026 budget will come from a presidential decree.

Our take: Considering the government's current political capital, the proximity of the legislative elections (less than seven months away) and the number of reforms currently under consideration by Congress (including the healthcare bill and the competence law, to name a few), we acknowledge that passing tax reform is crucial for fiscal consolidation and achieving a fiscal deficit of 6.2% of GDP in 2026 (down from 7.1% in 2025, according to the Medium term fiscal framework). If the reform is eventually turned down by Congress, the 2026 budget should automatically be adjusted downwards by 1.4% of GDP to 27.5% even if budget is approved by presidential decree. However, according to the Fiscal Council, to accomplish the Medium term fiscal framework targets, the budget requires a larger adjustment, equivalent to 2.4% of GDP.