2026/01/23 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

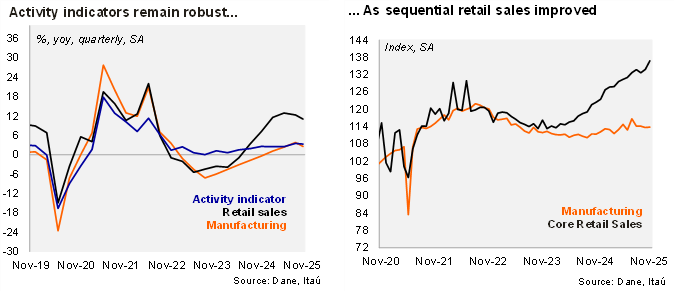

Retail sales were still strong in November. Retail sales rose by 7.5% YoY in real terms in November (+10% YoY in October), slightly lower than Bloomberg market consensus of 8.2% YoY, but above our 5.5% YoY call. Core retail sales (excluding fuels and vehicles) rose by 2.2% MoM/SA (+0.9% in the previous month), leading to an 11.7% YoY rise in real terms (+10.3% YoY in the previous month). Meanwhile, manufacturing increased sequentially by 0.1% MoM/SA (-0.4% MoM/SA in October), resulting in a 1.7% YoY increase (+1.1% in the previous month), below the Bloomberg market consensus of 1.9% and our 2.6% call.

Despite the slower pace, retail sales continue to expand at the margin. During the quarter ending in November, manufacturing increased by 2.5% YoY (+4.1% rise in 3Q25). At the margin, manufacturing dropped 2.4% QoQ/saar (down from +5.3% in 3Q25). Retail sales rose 10.4% YoY in the quarter ending November (+15.2% in 3Q25), while core retail sales increased 11.1% YoY (+12.9% in 3Q25), driven by IT equipment and vehicle sales. Sequentially, core retail sales increased 6.0% QoQ/saar (from +8.5% QoQ/saar in 3Q25).

Our Take: Looking back through the rearview mirror, we estimate 2025 GDP growth of 2.8%, up from 1.6% in 2024. Solid household spending supported by a tight labor market and strong gains in real wages continues to be one of the key engines of economic activity in the short-term. However, GDP growth is expected to gradually slow to 2.3% amid higher interest rates in response to the sharp increase in the minimum wage.