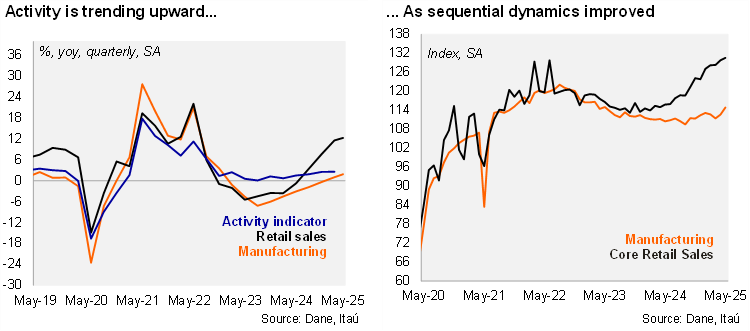

In annual terms, retail sales increased by 13.2% YoY in May (+11.4% YoY in the previous month), above the Bloomberg market consensus of 12.1% and our 9.5% forecast. Core retail sales (excluding fuels and vehicles) increased by 0.6% from April (MoM/SA), leading to a 14.5% YoY increase (+11.8% in April). Retail sales were boosted by vehicle sales, IT and telecommunications equipment. Meanwhile, manufacturing increased by 2.0% MoM/SA (+1.1% in the previous month), resulting in a 3.0% YoY expansion—higher than the Bloomberg market consensus of 2.0% and our 0.5% forecast. Thus, the data introduces an upside bias to the monthly activity indicator (ISE) for May to be released next Friday. We now expect an annual increase of 3% (2.0% previously), driven by tertiary activities, mainly commerce and entertainment, partially offset by mining and construction.

Sequentially, retail sales remained strong in May. During the quarter ending May, manufacturing increased by 1.5% YoY (+1.9% in 1Q25). At the margin, manufacturing increased by 0.7% qoq/saar, below the 2.4% in 1Q25. During the quarter ending May, retail sales increased 12.4% YoY (10.1% in 1Q25), while core retail sales rose 12.6% YoY (+10% in 1Q25). Sequentially, core retail sales increased 10.5% qoq/saar (from +16.5% in 1Q25).

Our take: Domestic growth remains on a favorable trend, while manufacturing starts to show better performance. We expect activity to grow by 2.5% YoY this year (up from 1.7% in 2024), supported mainly by private consumption. The improving growth trend, along with a tight labor market, sticky services inflation and fiscal challenges, are further reasons to expect a gradual cutting path ahead. We only expect 2x25bps cuts during 2H25 to 8.75%.