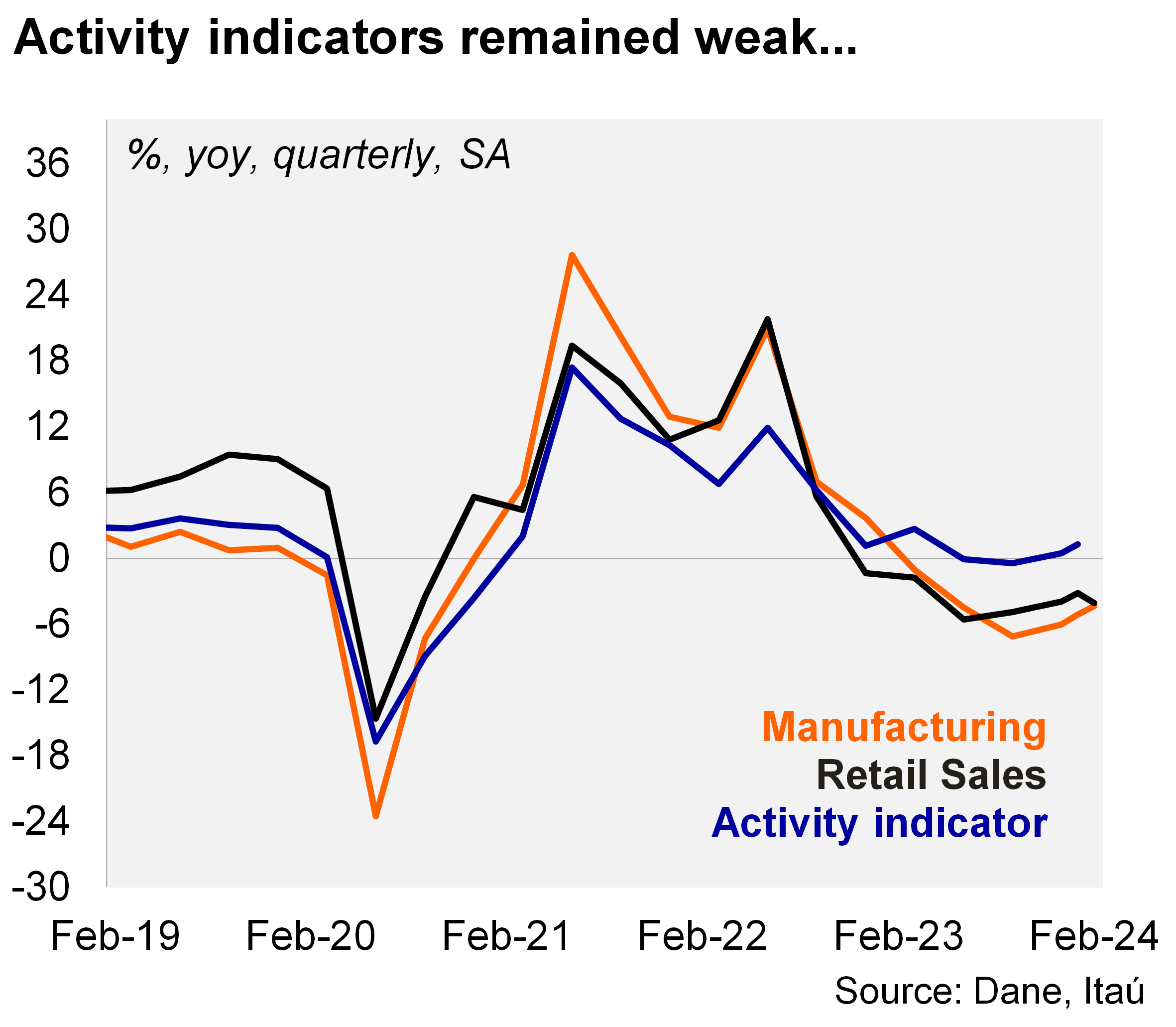

Retail sales and manufacturing fell sequentially in February. Real retail sales contracted 1.8% YoY in February (-4.1% in January), closer to our -1.5% call, while milder than the Bloomberg market consensus of -2.7%. Core retail sales (excluding fuels and vehicles) fell 1.4% from January (MoM/SA, +0.5% registered in the previous month), leading to a 1.1% YoY decline (-4.2% in January). Meanwhile, manufacturing contracted 0.5% MoM/SA (-0.5% in January), leading to an 2.2% YoY decline (-4.3% previously), less than the Bloomberg market consensus of -2.8% and closer to our 2.5% drop. We expect the monthly activity indicator to rise 1.4% YoY (risk tilted to the upside, to be published on Thursday 18). Retail and manufacturing continued to shrink in annual terms despite the favorable leap-year effect.

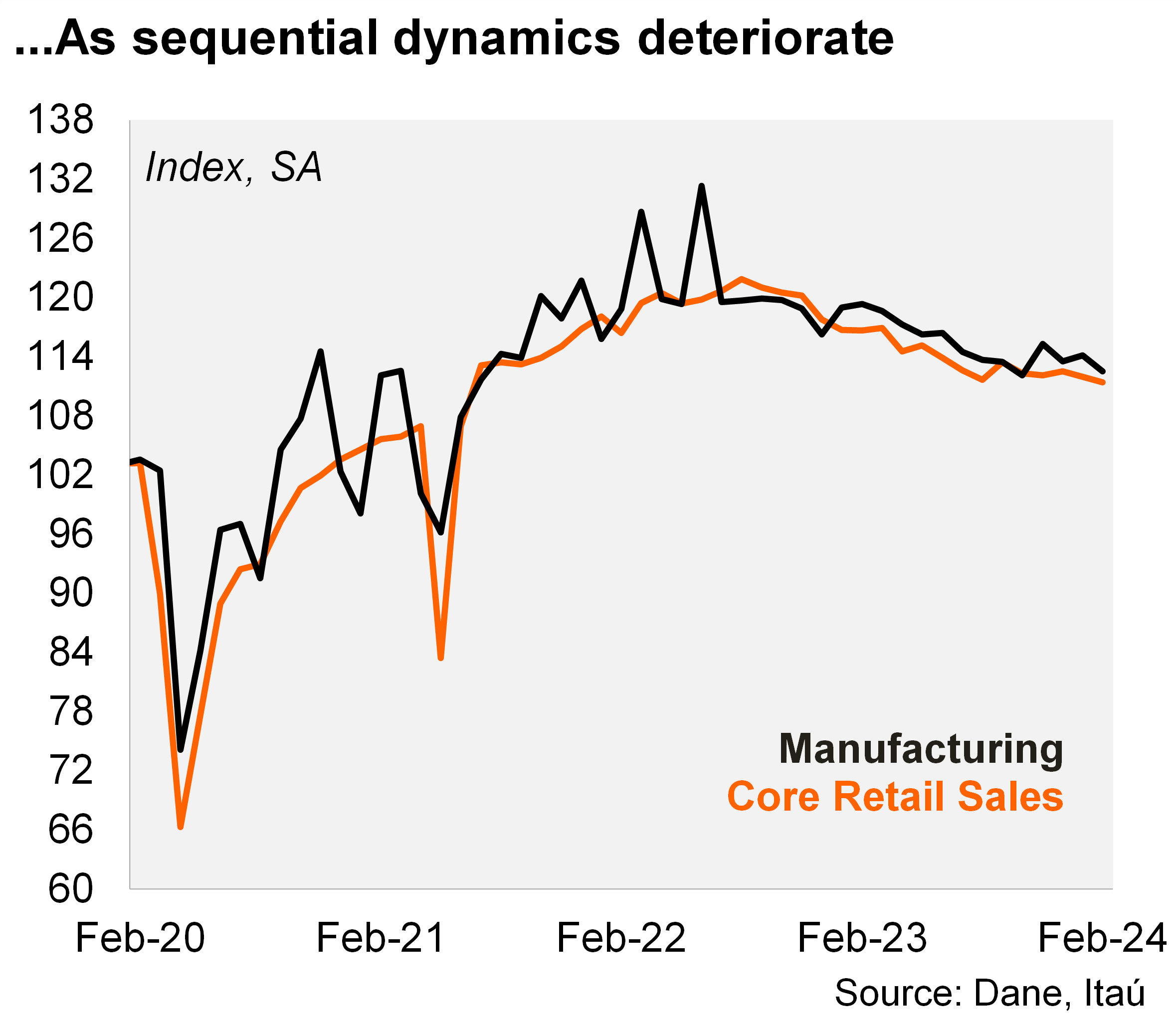

Manufacturing continues to trend down, dragged by vehicles and motorcycles production. During the quarter ending in February, manufacturing fell 4.5% YoY (6.4% drop in the 4Q23). At the margin, manufacturing contracted 2.3% qoq/saar (-0.9% in 4Q23). Manufacturing levels are now just 8.5% above pre-pandemic levels (down from a near 18% peak during 3Q22).

Widespread drag for retail sales. Activity in February was pulled down by vehicles, motorcycles, computer and telecommunications equipment. In the quarter ending February, retail sales contracted 3.6% (6.2% drop in 4Q23), while core retail sales dropped 2.7% (-4.3% in 4Q23). At the margin, core retail sales fell by 0.8% qoq/saar (in line with the drop in 4Q23). Core retail sales now sit 8.7% above pre-pandemic levels (+27% by mid-2022).

Our take: We expect the economy to grow at 1.0% this year (0.6% in 2023). Falling activity at the margin consolidates our view that monetary easing will continue at the next monetary policy meeting (April 30), with a 50 bps cut.

|  |

Andrés Pérez M.

Vittorio Peretti

Carolina Monzón

Juan Robayo