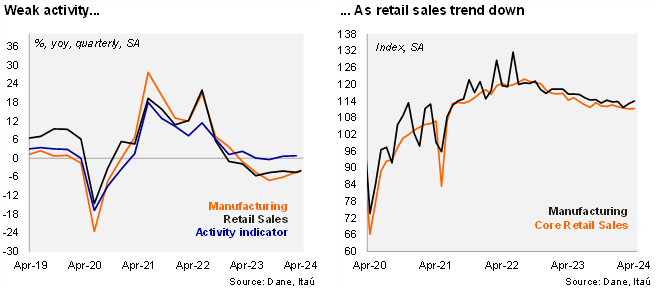

While core retail sales increased from March to April, and manufacturing ticked up sequentially, activity remained weak. In annual terms, retail sales contracted 1.6% YoY in April, the mildest contraction since February 2023 but still underwhelming market expectations (Bloomberg consensus: +1.8%; Itaú: +2.6%). Core retail sales (excluding fuels and vehicles) increased 0.9% from March (MoM/SA), leading to a 3.3% YoY decline (-2.3% YoY in March). Meanwhile, manufacturing rose 0.1% MoM/SA (the first positive result this year), leading to a 4.1% YoY increase (-11.1% previously), above the Bloomberg market consensus of 3.7% (Itaú: 3%). Of note, April was boosted by additional workings. Adjusting for both calendar and seasonal effects, manufacturing contracted 2.6% YoY (4.8% drop in March). Overall, retail and manufacturing dynamics remain weak as elevated interest rates and still high inflation dent domestic demand.

Manufacturing in the quarter contracted at the margin. Manufacturing fell 3.3% YoY in the rolling-quarter (-6% in 1Q24), and down 3.9% after correcting for seasonal and calendar effects. At the margin, the speed of the manufacturing adjustment accelerated to -3.1% qoq/saar (-1% in 4Q23 and -2.7% in 1Q24).

Core retail sales fell 3.6% qoq/saar, a similar pace to that registered in 4Q23 and 1Q24. During 1Q24, retail sales contracted 3.1% YoY (3.1% down in 1Q24), while core retail sales fell 2.4% (-4.3% in 4Q23 and down 2.7% in 1Q24).

Our take: We expect a gradual activity recovery this year, limited by tight global financial conditions and contractionary monetary policy. We expect growth of 1.2% this year, slightly above the 0.6% registered in 2023. Despite weak demand, BanRep’s board is expected to remain cautious amid a challenging domestic fiscal scenario, tight global financial conditions, and above-target inflation expectations. We expect BanRep to proceed with a 50-bp rate cut pace in the near term, and to reach 8.75% by year-end.