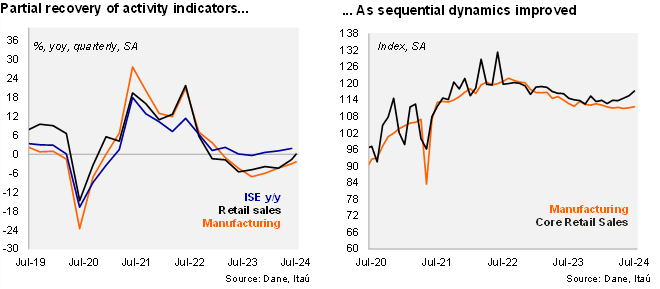

Retail sales and manufacturing increased at the margin in July. In annual terms, retail sales increased 1.6% YoY in July, broadly in line with our +1.5% call but below the Bloomberg market consensus of +2.8% YoY. Core retail sales (excluding fuels and vehicles) increased 1.5% from June (MoM/SA), leading to a 1.1% YoY decline (+1.1% YoY in June). Meanwhile, manufacturing increased by 0.4% MoM/SA, leading to a 2.0% YoY expansion (-4.9% previously), well above the Bloomberg market consensus and our call of -1.1%. The data puts an upside bias to our estimate for the monthly activity indicator (1.0% YoY expansion, to be published on Wednesday 18). Although interest rates and inflation remain high, activity indicators suggest some recovery at the margin, lifted by retail sales.

Manufacturing levels are stabilizing. Manufacturing was boosted by iron, steel and food industries, but partially countered by vehicles production.During the quarter ending in July, manufacturing fell 2.1% (-1.6% drop in 1Q24). At the margin, manufacturing contracted 8.6% qoq/saar (-6.4% in 2Q24). Manufacturing levels are now 8.1% above pre-pandemic levels (down from a near 18% peak during 3Q22).

The annual retail sales increase was boosted by vehicles and motorcycles, information and communications equipment. During the quarter ending in July, retail sales increased 0.5% YoY (0.6% drop in 2Q24), while core retail sales dropped a milder 0.6% (-1.3% in 2Q24). At the margin, core retail sales improved to +8.6% qoq/saar (+4.2% increase in 2Q24). Core retail sales now sit 13.3% above pre-pandemic levels (+27% by mid-2022).

Our take: We expect the economy to grow at 1.6% this year (0.6% in 2023), where the prior upward bias was partially stifled by the transportation strike. While the economy will continue to grow below potential this year, inflation remains well above the target and inflation expectations are not anchored. As a result, we continue to expect that central bank to advance cautiously, implementing another 50bp cut at the end of the month.