2025/11/14 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

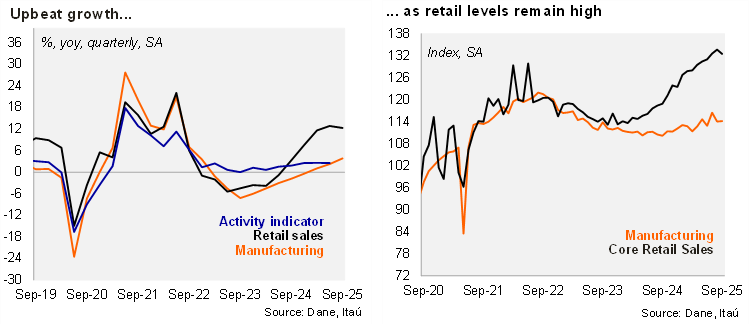

Retail sales and manufacturing surprised consensus to the upside in September. Retail sales increased 14.4% YoY, in September (+12.8% in August), above the Bloomberg market consensus of 13.7% and our 13.8% call. Core retail sales (excluding fuels and vehicles) fell 0.9% MoM/SA, but still rose 11.4% YoY (+13.8% previously). Manufacturing increased 0.1% MoM/SA (-2.1% in August), leading to a 5.2% YoY rise (+0.9% previously), above the Bloomberg market consensus of 4.0%, but below to our 5.7% call.

Strong activity dynamics at the margin. During the third quarter of the year, manufacturing increased 4.0% YoY (+0.6% rise in 2Q25). At the margin, manufacturing increased 5.3% qoq/saar (up from 3.6% in 2Q25). Moreover, retail sales rose 15.2% YoY in 3Q25 (+12.0% in 2Q25), with core retail sales up by 12.9% YoY in 3Q25 (+12.6% in 2Q25). Sequentially, core retail sales growth increased to 8.2% qoq/saar (from +9.0% in 2Q25). Within the quarter durable good sales led the outcome with computers, vehicle, and home appliances sales expanding at a superlative pace of 52.4% YoY, 34.4% YoY and 23,9% YoY each.

Our take: The data puts an upside bias to the monthly activity indicator (ISE) for September. We expect an annual increase of 3.5%, mainly driven by entertainment and commerce, but countered by mining and construction. Overall, we expect GDP growth of 3.2% in the third quarter of the year (to be released on November 18). We expect the economy to grow 2.7% this year, up from 1.6% in 2024. Amid a tight labor market, strong private consumption dynamics support the activity recovery this year. Nevertheless, along with the activity recovery, the continuous fiscal imbalance limit the scope for monetary policy easing. Our scenario sees the policy rate remaining unchanged at 9.25% until the latter part of 2026.