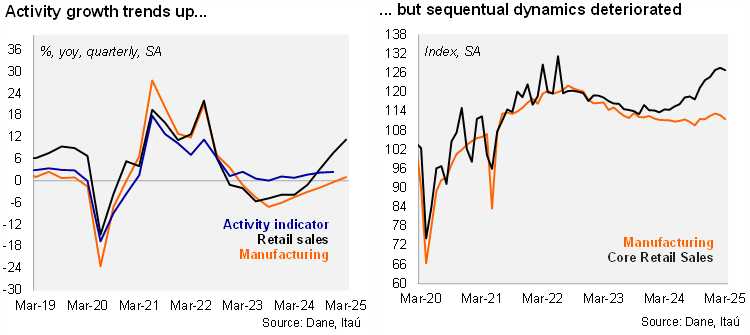

Annual growth of retail sales and manufacturing surprised to the upside in March. Retail sales increased 12.7% yoy in March (+7.5% in February), above the Bloomberg market consensus of 10% and our 11.2% call. Core retail sales (excluding fuels and vehicles) fell 0.6% mom/sa, but still resulted in a 11.7% yoy rise (+7.8% previously). Manufacturing dropped by 1.1% mom (-0.4% in February), leading to a 4.9% yoy rise (-1.2% previously), above the Bloomberg market consensus of 1.9% and our 2.4% call. Thus, the data puts an upside bias to the monthly activity indicator (ISE) for March. We expect an annual increase of 2.5%, mainly driven by entertainment, public administration, and commerce. Overall, we expect GDP growth of 2.3% in the first quarter of the year (to be released on May 15).

Sequentially, sectoral activity lost momentum in 1Q25. During the first quarter of the year, manufacturing increased 1.8% yoy (+0.6% rise in 4Q24). At the margin, manufacturing increased 2.5% qoq/saar (down from 4.7% in 4Q24). Moreover, retail sales increased 10.1% yoy in 1Q25 (+9.1% in 4Q24), with core sales up by 10.1% (+7.2% in 4Q24). Sequentially, core retail sales growth slowed to 13.2% qoq/saar (from +18.1% in 4Q24).

Our take: Domestic demand growth showed signs of recovery in 1Q25. We expect the economy to grow 2.0% this year, still below potential (2.8% in the last IPoM), but with an upside bias.