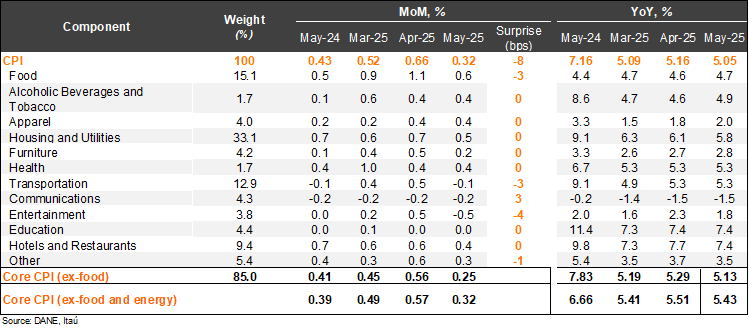

Consumer prices rose by 0.32% MoM in May, below the Bloomberg market consensus of 0.39% and our 0.40% call. The main positive contributors in the month were housing and utilities (+0.48%; +15bps); food prices (+0.60%; +11bps) and hotels and restaurants (+0.36%; +4bps). Food prices and entertainment explained most of the surprise relative to our forecast. Consumer prices excluding food increased 0.25% mom (+0.41% one year earlier), while inflation excluding food and energy rose by 0.32% (+0.39% one year ago). On an annual basis, headline inflation fell by 11bps from April to 5.05% in May, while core inflation dropped by 8bps to 5.43%, not only resuming its downward trend but also returning to March level (10.60% peak in April 2023). Cumulative inflation in the year rose to 3.6% ( 3.78% in 2024), already above the central bank’s target.

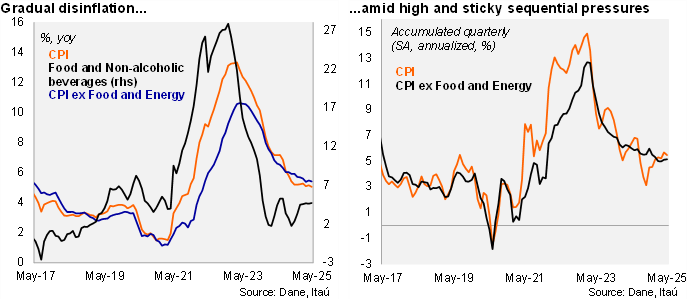

Sequential inflation pressures remain at elevated levels. Non-durable goods inflation (mainly food) came in at 3.9% YoY, falling 9bps from the previous month. Meanwhile, energy inflation dropped to 2.75% YoY, down 89bps from April. Durable goods inflation remained in negative territory at -0.5%, but increased 98bps from the previous month. Services inflation fell by 26bp to a still high 6.6% (9.51% peak in September), as rent prices gradually normalize. At the margin, we estimate that inflation accumulated in the quarter reached 5.5% (SA, annualized; 5.2% in 1Q25). Core inflation remains elevated at 5.1%, from 5.0% in 1Q25 (SA, annualized).

Our take: This will be the latest inflation data to be taken into account by the Central Bank Board ahead of its next meeting on June 27. Our preliminary estimate for June’s CPI, to be released on July 7, is between 0.1% and 0.2%, resulting in annual inflation falling close to 4.9% a level far above BANREP’s technical staff estimate at the last IPoM (4.3% by Jun-25). Our YE25 CPI call is 4.8% YoY, but with an upside bias, given that despite the downside surprise, rent prices remain sticky. Amid rising fiscal concerns and a CPI still above 5%, BanRep may opt to pause the easing cycle at the next policy rate meeting (set for June 27), after the 25bps cut made in April’s meeting.