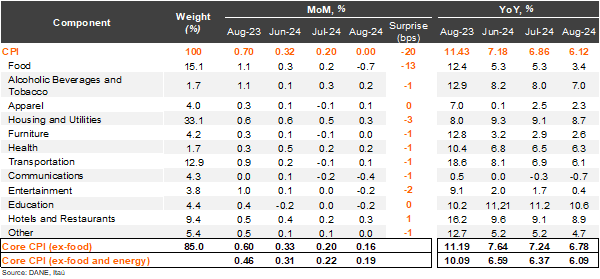

Consumer prices were stable between July and August, well below both the Bloomberg market consensus and our call of 0.2%. The main positive contributors in the month were housing and utilities (+0.3% MoM; +9bps), hotels and restaurants (+0.31% MoM; +3bps) and transportation (+0.13% MoM; +2bps). In contrast, food prices fell 0.68% MoM, subtracting 13bps from the monthly variation. Consumer prices excluding food rose 0.16% MoM (0.60% one year earlier), while inflation excluding food and energy rose by 0.19% MoM (core; 0.46% one year earlier). Overall, annual headline inflation fell by 74bps from July to 6.12%, while core inflation dropped from 6.37% to 6.09% (10.60% peak in April last year).

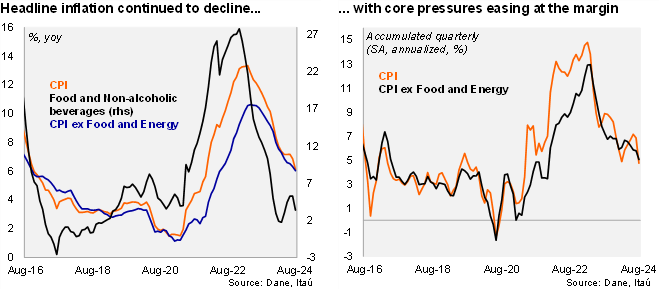

A widespread deceleration in inflation, but services remain elevated. Non-durable goods inflation (mainly food) came in at -0.35% YoY, dropping by 158bps from the previous month. Meanwhile, energy inflation fell to 13.74%, a drop of 225bps from July. Durable goods inflation remained in negative territory, falling on an annual basis from -4.94% to -5.32% (16.8% peak in January 2023), still dragged by a softening domestic demand. Services inflation fell only 21bps to 7.84% (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter was 4.8% (SA, annualized; 7.2% in 2Q24), registering its lowest level since April 2021. Core inflation moderated to 5.1% from 5.9% in 2Q24 (SA annualized).

Our take: Although the large downside surprise was mainly driven by food prices, the core disinflation processes continues to progress despite stickiness in certain services (rentals). The recent trucker strikes may see a significant transitory food price rebound in September. Our preliminary estimate for this month's CPI, to be released on October 7, is between 0.3% and 0.4%, resulting in annual inflation falling to 5.95%. We expect a YE24 CPI at 5.6%, with risks tilted to the upside given the diesel price increase announced by the government and rental price dynamics. While we think the central bank’s Board will maintain the 50bp cutting pace at the end of the month, a swifter easing cycle by the Fed, together with declines in CPI expectations may lead to greater appetite within the Board to accelerate the pace of cuts.