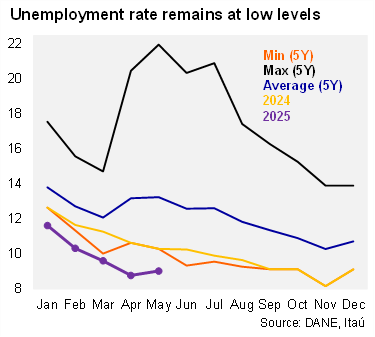

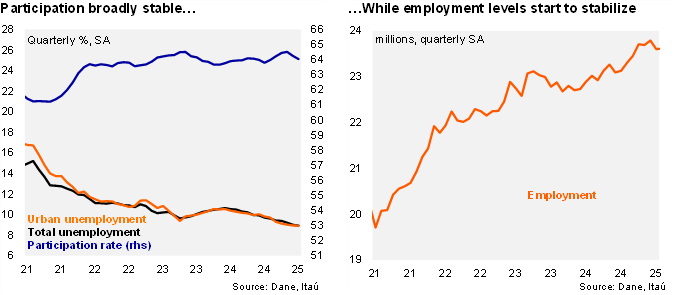

The urban unemployment rate stood at 9.0% in May, a drop of 1.3pp over one year, while slightly above the Bloomberg market consensus of 8.9% and our 8.8% call. Employment rose by 2.6% YoY in May (+3.1% YoY in April), while the labor force increased by 1.2% (+1.0% in the previous month). The participation rate was broadly stable over one year at 64%. Sequentially, employment remained unchanged from April (SA; -0.8% in the previous month), while the unemployment rate (SA) ticked up to 9.0% (+0.2pp MoM; BanRep’s NAIRU: 10.2%).

Self-employment and private salaried positions were the main job creators. In the quarter ending May, employment increased by 3.5% YoY (+4.3% in 1Q25). The annual increase was driven by private salaried positions (+2.4% YoY, +3.1% YoY in 1Q25), while self-employment increased by 6.3% (+7.0% in 1Q25). On the other hand, public sector jobs fell by 7.3% (-4.2% in 1Q25). In the quarter ending May, real estate, transportation, hotels, restaurants, agriculture, and commerce were key job drivers on an annual basis.

Our Take: We expect the unemployment rate to close in single digits this year at 9.8%, given favorable dynamics in key sectors such as commerce, hotels, and restaurants. A tight labor market, amid fiscal uncertainty, favors a cautious stance in BanRep’s easing cycle.