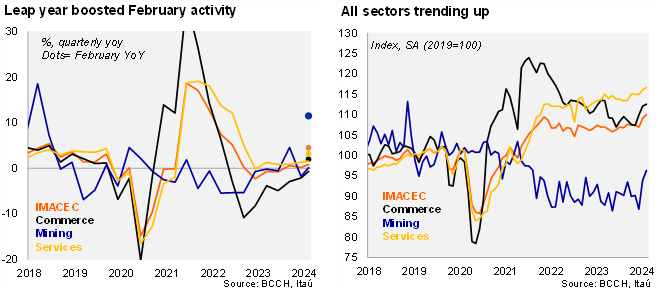

The monthly GDP proxy (IMACEC) increased 0.8% from January to February (SA), leading to a 4.5% YoY in February (+2.3% in January), well above the Blomberg market consensus and our call of 3.3%. The elevated annual rise was boosted by the leap-year effect (estimated recently by the BCCH at +1pp). After the economy rose 2.0% MoM/SA in January, the 0.8% increase in February was lifted by mining (+0.3pp), services (+0.2pp) and manufacturing (+0.2pp; suggesting limited impact from February’s wildfires). Non-mining activity rose 3.5% YoY (2.5% in January), pulled up by the 6.7% YoY increase of other goods (particularly electricity generation), while manufacturing (5.2% YoY) and services (3.2%) were also key drivers. Mining also recovered (+11.5% YoY). Overall, revised national accounts and the strong start to the year should lead the central bank to revise the 2024 GDP growth forecast up from the 1.25 – 2.25%.

During the quarter ending in February, non-mining activity advanced on its recovery path. The headline IMACEC increased 1.9% YoY in the quarter (0.4% in 4Q23), with non-mining up 1.9% (0.8% in 4Q). Services (2.6%) and manufacturing (1.9% YoY) were key pulls in the quarter. Commerce contracted by a milder 0.2% (3.5% down in 4Q), and is expected to return to positive figures in 1Q24. Mining rose 2.1% (2.5% drop in 4Q23. At the margin, IMACEC increased 4.3% qoq/saar (0.6% in 4Q), lifted by mining and the 4.4% non-mining rise (2.5% in 4Q) as commerce and services advance.

Fiscal spending has also supported activity in the year. The central government’s real expenditures rose by 15.1% YoY in February, rising materially for the second consecutive month (7.5% in January). Current expenditures rose by 9% YoY, primarily due to subsidies and donations, as well as base effects of state-financed pension payouts. Capital expenditures had an eye-popping rise of 86.3% YoY, which were driven by 146.9% YoY increase in public investment and a 66.7% YoY rise in capital transfers to regions. In our view, the large expenditure increases reflect a payback from the lower spending of December 2023 (-5.6% YoY), which were an effort to comply with the 2023 fiscal targets amid low liquid assets. Expenditures in the year have increased by 11.2% YoY through February, well above the MoF’s 2024 projected 5.6% YoY rise.

Leading indicators continue to point to a gradual recovery. Think-tank ICARE’s business sentiment improved at the margin in March, rising for the third consecutive month, yet is still in pessimistic territory. Business confidence rose to 46.3 points (50 = neutral; 44.9 in February), with the non-mining index at 42.2 (40.8 in February). Imports of consumer goods are growing during 1Q (but capital goods imports are weak). Real bank credit’s annual growth remained slightly positive for the second consecutive month in February, while upbeat sequential employment growth and rising wages have led to an improving real wage bill.

Our take: The activity rebound this year will be lifted by private consumption given lower inflation and interest rates, while mining dynamics seem set to improve. Despite falling interest rates, investment is likely to remain weak. The strong fiscal expenditure pull at the start of the year will likely need to be reeled in during the latter part of 2024 in order to meet fiscal targets. Overall, the economy will grow above our current 1.7% call. All in all, the volatility of monthly data will continue in March, given the rare occurrence of Easter unfolding during the month. Our preliminary estimate for March’s IMACEC (to be published on May 2) points to a 1-2% YoY growth range.