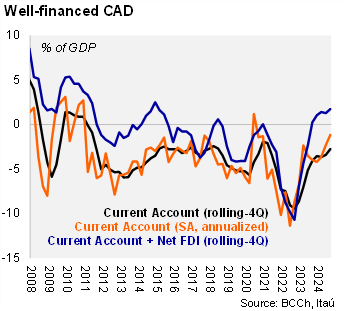

The current account balance in 3Q24 came in at a deficit of USD 3.1 billion (3.9% of GDP; Itaú: USD 2.8 billion). The deficit was below the USD 5.3 billion deficit of 3Q23 (but larger than the small deficit in 2Q24), resulting in the rolling-4Q CAD reaching 2.7% of GDP (from 3.3%). The CAD in the quarter was supported by a large USD 4.3 billion trade surplus for goods (USD 1.9 billion one year earlier). On the other hand, the income deficit came in at USD 5.3 billion (USD 5.1 billion in 3Q23), as elevated copper prices likely favored FDI investments. The CAD was favorably financed, with net FDI coming in at USD 5.3 billion, exceeding the quarterly CAD. Overall, the normalization of domestic demand has contributed to a sustainable balance of payments scenario.

Copper exports supported a large trade surplus for goods. Exports of goods increased 8.9% yoy (+6% in 2Q24) in 2Q24. Copper exports rose 24% YoY, boosted by both prices (16% yoy), and volumes (5.1% yoy). Imports of goods fell 2% yoy, as rising consumer goods imports and a softer capital goods decline is dragged by weak energy import dynamics. The services trade deficit narrowed by around USD 0.4 billion over one year amid an 25% rise in exports (primarily due to inbound tourism). The rolling-4Q income deficit continued to tick up to USD 20.2 billion (USD 17 billion last year; USD 14.2 billion in 2022), lifted by the return of FDI in Chile.

FDI dynamics remain upbeat. The USD 3.8 billion of direct investment into Chile was led by profit reinvestments. The rolling-4Q net FDI reached USD 14.5 billion (4.4% of GDP), exceeding the comparable CAD of USD 8.9 billion (2.7% of GDP).

Our take : Still soft domestic demand and sustained export growth have supported a large trade surplus scenario. We expect the CAD to come in at a smaller 2.4% of GDP this year (vs. 3.6% in 2023). While short-term inflation pressures are tilted to the upside, they are supply-side derived. The soft domestic demand scenario, still tight loan conditions and a stagnating labor market are in line with the central bank’s view of lower rates over their two-year forecast horizon. We expect the policy rate to end the year at 5.0%, 25bps lower than the current level.