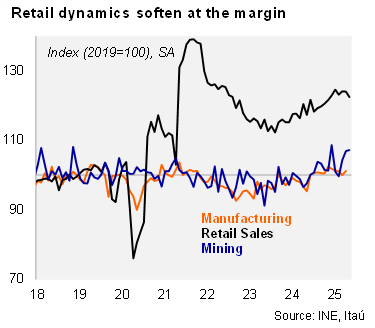

The upbeat retail dynamics are starting to weaken, while the mining pull consolidates. Real retail sales fell 1.2% MoM/SA from April to May and grew by 4.5% YoY, well below market expectations (Itaú: 8%, Bloomberg: 7.6%; 3.1% in April). While inbound tourism levels are near record high, the marginal impact is expectedly fading. Foreign tourism inflows rose by 11% YoY in May, down from the 47% registered in 1Q25. Additionally, stagnant employment levels and uncertainty around the effects of a global trade war and the conflict in the Middle East may tilt consumers towards a more conservative spending stance (as focus shifts to building savings). Manufacturing rose 1.2% MoM/SA, leading to growth of 2.9% YoY (Itaú: 6.5%, Bloomberg: 4.1%; -0.1% in April), lifted by paper & pulp. Mining increased 9.8% YoY (10.5% YoY in April), favored by improved ore-grade. Mining has averaged annual growth of 7.7% this year (4.4% in 2024).

Activity dynamics at the margin show mining leads the growth charge, while retail sales are flat and manufacturing remains a drag. Retail sales momentum in the latest quarter was steady (0% QoQ/saar), a significant downturn for the 7.6% in 1Q25 and 9% in 4Q24. Manufacturing fell 4.2% QoQ/saar (+1.1% in 1Q25). Mining momentum rebounded with growth of 12.3% QoQ/saar (-8% in 1Q25).

Our Take: Following today’s sectorial data, we revised our May IMACEC estimate down by 30bps to 3.8% YoY (2.5% in April). The closure of schools during May last year amid heavy rainfall will provide services with a favorable base effect. The BCCh will publish May’s IMACEC on June 01. We expect GDP growth of 2.6% this year, lifted by recovering mining-related investment and private consumption. Overall, the activity recovery and disinflation process have unfolded broadly in line with the Central Bank’s expectations, coherent with monetary policy easing in the upcoming quarters (towards the 4% nominal neutral rate). With weak labor dynamics, contained credit dynamics and, non-mining activity slowing at the margin, we believe the Board may already cut rates in July.