2025/11/18 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

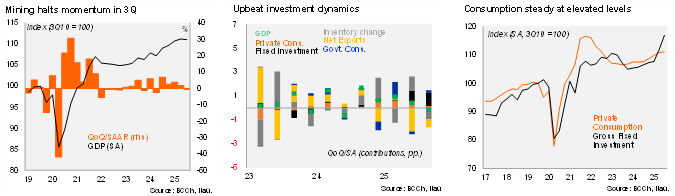

According to the Central Bank, the Chilean economy grew 1.6% YoY during 3Q25, below the monthly proxy Imacec of 1.8%. Activity growth during 1H25 was revised up 10bps to 2.9%. Activity during 3Q was dragged down by the 6.5% annual mining contraction amid transitory supply shocks (sharper than the 4.7% drop signaled by the IMACEC). Non-mining activity rose by a robust 2.6% (broadly in line with the IMACEC; 3.2% in 2Q). Private consumption rose by 2.9% YoY ( 3.1% in 2Q), while gross fixed investment growth surged to 10% YoY (5.8% in 2Q), in line with the upbeat imports of capital goods, elevated copper prices and improving private sentiment. Investment was led primarily by the machinery and equipment component, reflecting increased investment in transportation equipment—trucks and buses—and in electrical and electronic machinery and equipment, mainly for power generation projects. The construction and other works component also showed positive figures, led by engineering works. Exports were flat from 3Q24, while imports rose 13% YoY following the domestic demand recovery. At the margin, the overall economy shrunk by 0.6% QoQ/SAAR given the weak mining dynamics (-17% QoQ/SAAR). Mining has recorded sequential declines during all three quarters of the year. In contrast, non-mining GDP accelerated at the margin to 1.7% QoQ/SAAR, from 0.4% in the previous quarter, marking the fifth consecutive quarter of expansion.

Our Take: Non-mining activity continues to perform well, though weaker than expected mining output may result in 2025 GDP growth slightly below our 2.5% forecast. If activity remain at 3Q levels for the remainder of the year, GDP growth (SA) would come in at 2.3%. For 2026, we project growth of 2.2%, with upside risks if investment momentum continues and spreads to other sectors. Elevated terms of trade, lower inflation, and declining interest rates will support non-mining growth.