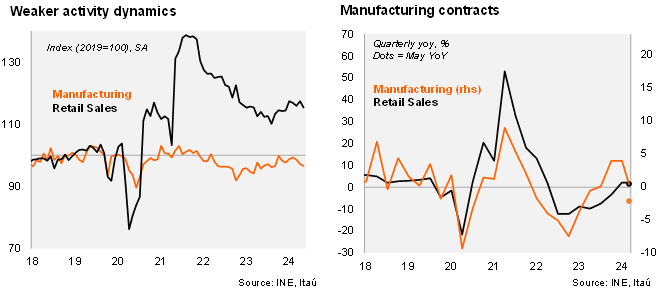

Retail and manufacturing activity fell sequentially in May, while mining and electricity generation were key drivers. Real retail sales fell 1.7% MoM/SA, leading to an annual increase of 1.5% YoY, well below market expectations (Bloomberg consensus: 2.6%; Itaú: 2.5%), and the 3.7% in April (albeit boosted by favorable calendar effects). Vehicles sales were a key drag, with overall durable goods sales down 4% YoY. Separately, manufacturing fell 0.7% MoM/SA, leading to an annual contraction of 2.2% (Bloomberg consensus: +2.1%, Itaú: +3.6%; +6.1% in April). Manufacturing was dragged by food related products (business strategy), rubber and plastics (closure of operations), as well as machinery and equipment (weak demand). Mining posted a sequential increase of 0.8% MoM/SA, leading to a 6.9% YoY change (-1.1% in April). Utilities rose 4.1% YoY (boosted by hydroelectricity generation). As a result, industrial production (grouping manufacturing, mining, and utilities) rose 0.6% MoM SA, consistent with a 2.3% YoY rise (+2.5% in April). We expect an IMACEC increase in May of 2.4% (to be published on July 1; 3.5% in April).

After an upbeat 1Q, activity is slowing. Total retail sales increased by 2.0% during the rolling-quarter (2.2% in 1Q), as durable retail sales slowed to 1.7% YoY (2.9% in 1Q24). Separately, total industrial production rose 1.7% in the quarter (3.8% in 1Q), with manufacturing increasing a mere 0.3% YoY (3.9% in 1Q), and mining up 3.5% (4.5% in 1Q). In seasonally adjusted terms, manufacturing fell 4.4% QoQ/saar (1.3% in 1Q), while retail sales were flat during the quarter (slowing from 8.5% QoQ/saar in 1Q). Overall industrial production dropped 3% QoQ/saar.

Our take: We expect lower average inflation, falling interest rates and a recovering mining sector to support a GDP rebound to 2.8% this year (0.2% in 2023). However, weak activity dynamics so far in 2Q pose downside risks to our call. A higher copper price outlook may support improved investment dynamics over our forecast horizon, supporting the persistence of a positive output gap. The expectation of far greater inflation pressures ahead (due to electricity price adjustments), may result in a slower convergence process to the 3% target. As a result, we believe the bulk of the cutting cycle has unfolded and expect the central bank Board to pause at 5.25%. Easing global financial conditions during 2025 may offer room for additional cuts.