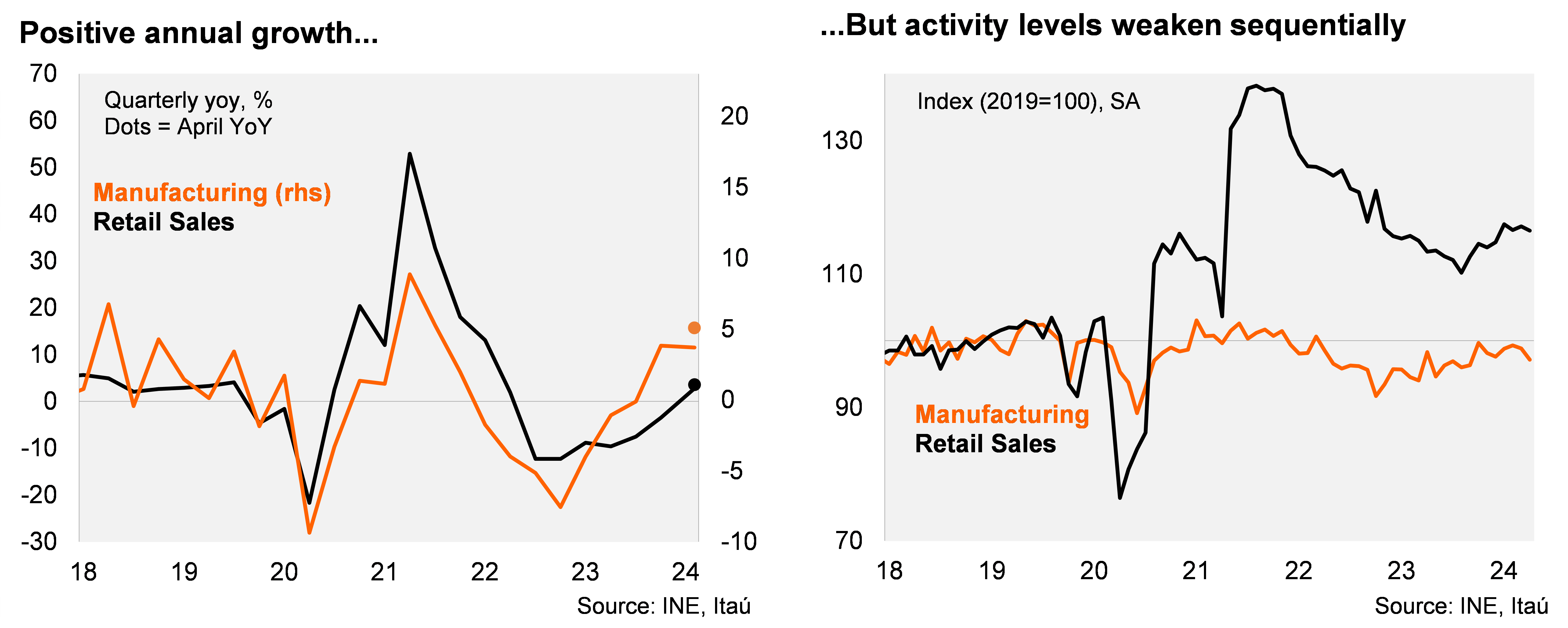

Sectorial activity fell sequentially in April, but favorable calendar effects boosted annual variations. Real retail sales (including vehicles) dropped 0.5% MoM/SA. In annual terms, retail sales increased by 3.6% YoY (up from 1% in March), in line with market expectations (Itaú: 5%), and boosted by three additional working days. Separately, manufacturing fell by 1.7% MoM/SA, building on the sequential drop in March, leading to a below-consensus annual increase of 5.1% (BBG: 6.9%, Itaú: 7%; - 2% in March). Mining posted a third consecutive sequential decline (down 2% MoM/SA), leading to a 1.1% YoY fall (the first negative print this year). Utilities also fell sequentially. As a result, industrial production (grouping manufacturing, mining, and utilities) fell by 1.6% MoM SA, consistent with a 2.0% YoY rise (+0.7% in March). The weaker-than-expected sectorial data leads us to expect a 3.4% annual IMACEC increase in April (to be published on June 3; 0.5% in March).

After an upbeat 1Q, activity momentum started to fade. Total retail sales increased by 2.8% during the rolling-quarter (2.2% in 1Q), led by durable retail sales (5.2% YoY). Separately, total industrial production rose 3.4% in the quarter (4% in 1Q), with manufacturing increasing 3.7% YoY (4.2% in 1Q), while mining increased by 3.7% (4.5% during 1Q). While market expectations are for mining production to rise by around 5% this year after resolving certain operational challenges, we do not expect further improvements in short-term production as a result of the surge in copper prices; however, the mining investment pipeline may increase, affecting output in the medium-term, if elevated prices are perceived to persist. In seasonally adjusted terms, retail sales increased 4.8% qoq/saar, slowing from 9.5% in 1Q, while manufacturing decelerated to 1% QoQ/saar (2% in 1Q). Overall industrial production increased by 0.3% QoQ/saar.

Our take: We expect lower average inflation, falling interest rates and a recovering mining sector to support a GDP rebound to 2.4% this year, with risks tilted to the upside (0.2% in 2023). A broadly closed output gap, along with anchored inflation expectations should allow for the BCCh to ease further. We see the central bank taking the policy rate to 5.25% this year, with further cuts dependent of global financial developments.

Andrés Pérez M.

Vittorio Peretti

Ignacio Martinez Labra