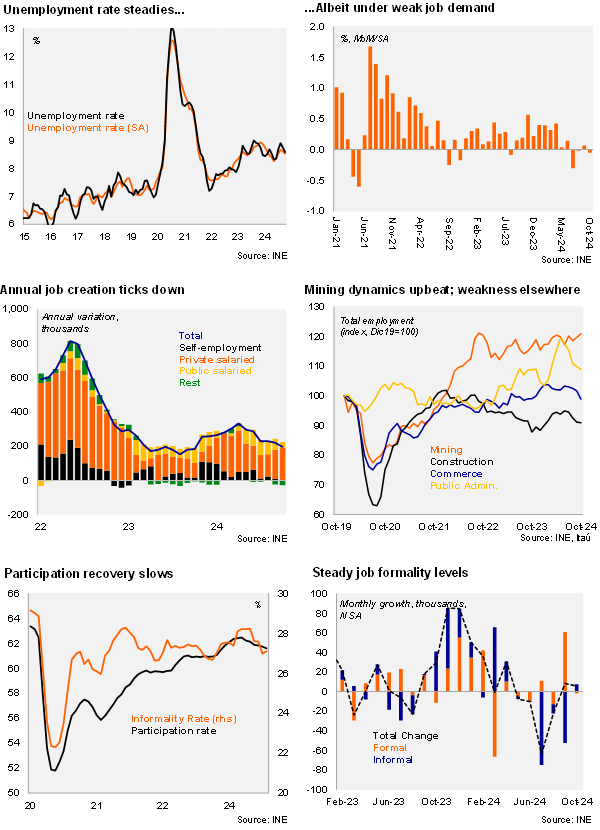

According to the INE’s labor market survey, the unemployment rate came in at 8.6% during the October quarter, in line with the Bloomberg markets consensus of 8.6% (Itaú: 8.7%). The unemployment rate implies a 0.3pp fall over twelve months (-0.2pp in the previous month). The participation rate increased 0.5pp YoY (to 61.6%; +1.3pp during 1H24), while employment rose by 2.2% YoY (3.3% in 1H24), driven by healthcare (4.1% YoY) and education (3.9%). The informality rate rose to 27.1%, up by 0.1pp YoY, yet below the 2018-2019 average (28.3%). At the margin, employment levels fell 0.1% from 3Q24, while the seasonally adjusted unemployment rate reached 8.5% in the quarter, up 0.1pp from 2Q (8.9% cycle peak in the las November quarter).

Administrative records from the Labor Directorate (available here) have shown a decline in layoffs based on firms’ needs, suggesting that most of the adjustment in the formal market have already taken place. Additionally, administrative data have shown a slowdown in the annual growth rates of unemployment insurance beneficiaries, while labor demand proxies have improved slightly at the margin yet remain well below pre-pandemic levels.

Our take: Although the unemployment rate is expected to decline in the coming months due to seasonal trends, the labor market is likely to remain weak. Current dynamics indicate that job creation will remain subdued as labor demand continues to be sluggish. We expect the unemployment rate to average 8.5% this year and the next. A still loose labor market, soft loan dynamics and anchored medium-term inflation expectations would likely lead the central bank to further cut the monetary policy rate. We see the cycle concluding at 4.5% in 1H25.