2026/01/30 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

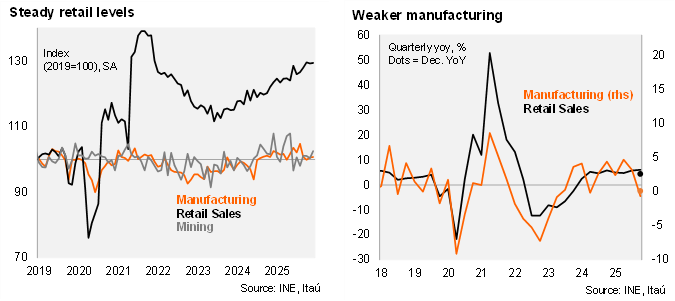

According to the National Statistics Institute (INE), mining production contracted 4.8% YoY in December, manufacturing was flat, while annual retail sales growth slowed. Manufacturing rose 0.1% YoY (-1.5% YoY in November), somewhat above the Bloomberg median of -0.1% (Itaú -1%). Production was lifted by foods while beverages was the most notable drag. The 4.8% YoY mining decline was dragged by copper, while a lithium gain moderated the overall fall. Mining faced a demanding base effect from 2024 when production rose by double digits at the close of the year. During the final quarter of the year, industrial production (mining, manufacturing and utilities) contracted by 1.1% YoY. Retail sales grew by 4.5% YoY, down from 5.8% in November. Apparel was a key upside pull in the month. Retail sales rose by 6% YoY in the quarter, a similar rate to 3Q25. Overall, we expect December Imacec to grow 0.6% YoY (to be released on Monday; 1.2% in November), with non-mining activity a tick above 1%. As a result, the economy would have grown by 1.3% in 4Q25 (1.6% in 3Q).

Sequentially, retail dynamics remain positive, but manufacturing is falling. Retail sales rose by 8.4% QoQ/saar in the fourth quarter of 2025 (3.4% in 3Q), while manufacturing decreased 8.1% QoQ/saar (+3.3% in 3Q25). After a significant drop in 3Q (-14% QoQ/SAAR), mining partially recovered with growth of 5.8% QoQ/saar.

Our take: Activity ended 2025 on a weaker footing than we had penciled in. If our December IMACEC estimate is correct, the economy would have grown 2.2% last year, weaker than prior estimates of 2.5% that we held at the start of 4Q. Going forward, easing inflation, and lower interest rates will help underpin private consumption as a key growth driver this year. While elevated copper prices would consolidate the sector’s investment pipeline, current production faces challenges. We also cannot rule out a wave of labor disputes given the significant terms-of-trade shock. Our 2026 GDP growth call is 2.6%. We estimate a carryover for 2026 of a mere 0.2%. With inflation falling more swiftly than the BCCh expected and activity dynamics not generating significant upside demand side inflationary pressures, we expect the BCCh to cut the policy ratye by 25bps to 4.25% in March, and adopt a wait-and-see approach as it navigates the next appropriate policy action.