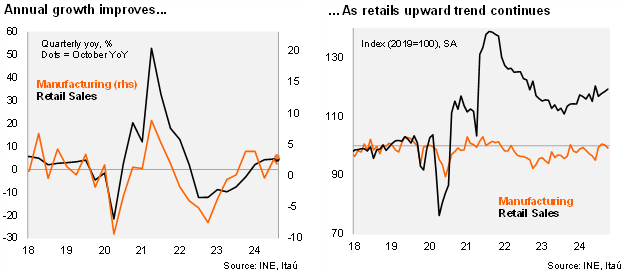

The upward retail sales trend persisted in October. According to INE's data, retail sales (including vehicles) increased 0.7% MoM/SA in October, leading to an annual increase of 4.5% YoY (4.1% in September), above the Bloomberg market consensus of 3% (Itaú: 1.8% call). Separately, manufacturing ticked down 1.1% MoM/SA, leading to a 3% YoY increase (-1.1% in September), in line with the Bloomberg market consensus (Itaú: 3.5%). Manufacturing was pulled up by beverages. Adjusted for seasonal and calendar effects, manufacturing contracted 1.2% YoY. Mining fell 1.8% from September, while grew 4.2% in annual terms (1.2% in September). Overall, industrial production (grouping manufacturing, mining, and utilities) increased 3.2% YoY (-0.4% in September), despite a sequential decline. Overall, we expect a 2.5% YoY increase for the IMACEC monthly GDP proxy for October (to be published on December 2; 0.3% in September).

Favorable activity momentum in the quarter. Total retail sales increased by 5.1% during the quarter (4.2% in 2Q and 4.6% in 3Q), with durable retail sales rising 6.6% YoY and non-durable goods increasing 4.7%. Separately, total industrial production rose 2.7% in the quarter (1.2% in 2Q and 2.9% in 3Q). Manufacturing growth came in at 1.9% (-0.4% in 2Q and 2.6% in 3Q), while mining rose an elevated 4.7%, the swiftest annual gain since early 2018. In seasonally adjusted terms, mining rose a swift 12.9% QoQ/saar, retail sales increased 3.9%, while manufacturing rose 12.9% QoQ/saar (-10.1% in 2Q).

Our take: We expect the economy to grow 2.2% this year. A softer China growth outlook, and tighter than expected global financial conditions would keep growth downbeat next year (1.9%).