2026/02/02 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

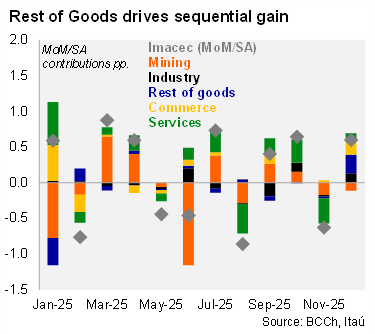

According to the Central Bank, December’s monthly GDP proxy (Imacec) grew 1.7% year‑on‑year during the final month of 2025 (1.2% in November), above Bloomberg’s median of 1% (Itaú: 0.6%). On a sequential basis, the seasonally adjusted series increased by 0.6% MoM/SA. Non‑mining activity expanded 3.0% annually (1.7% in November) and +0.8% in seasonally adjusted terms. The most relevant contribution to the annual result came from services (+2.2%, 0.9pp contribution), particularly personal health services. Commerce was another key driver, growing 6.6% YoY, boosted by wholesales (food and machinery). On the production front, manufacturing and rest of goods (agriculture, food processing) grew by 2.0% and 2.3%, respectively. Mining was once again a key drag, contracting by 8.1% YoY, hindered by base effects but also still shrinking sequentially amid challenges in the copper industry. The bulk of the surprise to our call came from commerce and rest of goods.

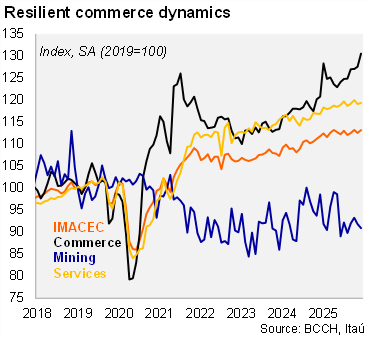

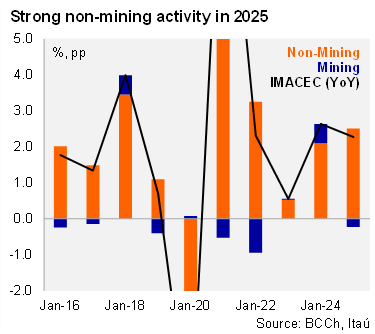

Sequentially, the economy grew at an annualized rate of 1.7% (QoQ/SAAR), pulled up by a near 10% gain in commerce. Services grew 1% QoQ/SAAR, while mining posted a partial recovery of 3% following the -17% slump in 3Q. Using the 4Q25 activity levels for the whole of this year results in a carryover of 0.3%. The Imacec is in line with GDP growth of 2.3% during 2025, a tick below the 2.4% expectation from the BCCh’s analyst survey. National account data in March will likely bring revisions to the data. Non-mining, boosted by services and commerce, lifted the economy last year with growth of 2.8% (2.3% in 2024). While expectations for mining at the start of last year were upbeat, the sector faced significant supply challenges leading to a 2.0% contraction (+5.2% in 2024).

Our take: Recovering private sentiment amid record high terms-of-trade, will support activity dynamics this year. We expect GDP growth of 2.6%, implying a significant sequential acceleration compared to last year. We assume the mining sector will return to growth territory, while elevated copper prices consolidate investment dynamics. Average inflation below the 3% target, along with lower average interest rates and a gradual recovery of the labor market will sustain commerce dynamics. Business sentiment at the start of the year surged to 52 (+7pp from December; 50 = neutral), the highest level since early 2022. Excluding mining, business sentiment neared neutral levels. Consumer sentiment also jumped to the highest level since early 2019, pulled up the on-year economic outlook for the country (58 points, 50 = neutral). Separately, the stock of bank credit in the Chilean system rose nominally by 2.1% YoY in 4Q25, similar to the whole of 2025, implying a real credit decline that we expect to unwind in 2026 amid more favorable rates, inflation and sentiment. The Board of the BCCh acknowledged that inflation has fallen more swiftly than forecasted in the 4Q IPoM. We expect the Board to bring forward the final 25bp cut to the March meeting (from 3Q26 signaled in the 4Q IPoM). Thereafter, we expect the Board to embark on a wait-and-see period as improving medium-term domestic demand drivers confront growing short-term CPI drags (from CLP and global goods supply).