2025/10/30 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

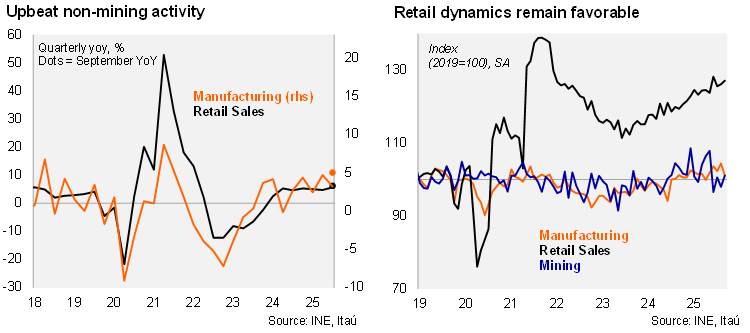

Real retail sales rose by 6.2% YoY (5.2% in August), above the Bloomberg market consensus (4.9%), but closer to our call 6.5%. Sequentially, retail sales increased by 0.8% MoM/SA. Retail dynamics have been boosted by new light motor vehicles, electronic, household and technological products. Manufacturing rose by 5.0% YoY (2% in August), below the Bloomberg market consensus of 7.4%, while closer to our call of 5.5%. Sequentially, manufacturing dropped 3.2% MoM/SA. Manufacturing was primarily pulled up by food processing (+13% YoY; 3.8pp contribution). Mining contracted for a fourth consecutive month (-1.8% YoY), despite some sequential recovery post the El Teniente event. Overall, industrial production posted a 1.5% YoY rise. Our IMACEC estimate for September, to be published on Monday, sits at 2.8% (EEE: 2.5%), with non-mining set to grow closer to 3.4%. The estimate is consistent with GDP growth of 1.7% in 3Q25, below the 2.5% estimate in the IPoM.

Weak mining dynamics, but non-mining momentum is favorable. Retail sales rose by 2.4% QoQ/saar in the third quarter of the year and 5.7% YoY (4.8% in 2Q). Manufacturing rose 3.2% QoQ/saar (0.5% in 2Q25) and also 3.2% YoY. Mining contracted by a whopping 13.7% QoQ/saar, and dropped 3% YoY (+5.6% in 2Q25).

Our take: Growth this year will be supported by resilient private consumption amid elevated real wage growth, along with the mining-led investment recovery. The supply shocks to mining limit our growth call to 2.5% growth call for the year. Business sentiment in October took a knock, dragged by a retreat in the construction sector despite signs of recovering home sales and improving credit dynamics. Non-mining business confidence sits at 41.2 (50 = neutral), the most downbeat since July last year. With non-mining activity still performing well, and the investment outlook continuing to improve, the Central Bank is accumulating more information on how core inflationary pressures evolve before resuming cuts towards neutral. Our baseline scenario includes a 25bps rate cut in December to 4.5%, but with significant risks that it is delayed to early 2026.