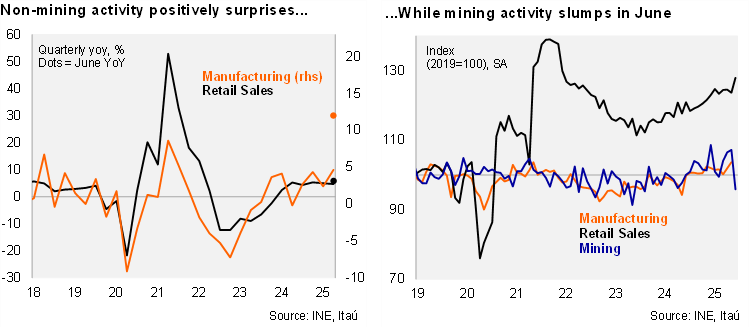

In recent months, retail sales had shown signs of stabilizing at elevated levels, but INE’s June data surprised with a notable 3.4% MoM/SA jump. The subsequent annual increase of 5.9% (5.2% in May), came in above the Bloomberg market consensus of 2.9% and our 2% call. June hosted Cyber sales events (as was the case in June 2024). Electronics, household goods, and technology products played a key role contributing to the annual increase (1.8pp), along with clothing, footwear, and accessories (0.7pp). While we await foreign tourism inflow data for June, the encroachment towards a more demanding base of comparison is expected to see a fading marginal impact. Additionally, weak labor market dynamics should contribute to a deceleration in the growth of the real wage bill. Consumer credit dynamics are improving, however. Manufacturing also grew by a robust 1.7% MoM/SA (in line with May), resulting in a 12% YoY rise (3% in May), well above the market consensus (Bloomberg 6.5%; Itaú: 6.2%). The 17.8% YoY increase in food processing (5.4pp contribution; linked to fish products) was a key driver. Favorable base effects also played a role in amplifying the annual figure. Mining posted a transitory, but eye-popping decline of 10.6% MoM/SA (-4.2% YoY). Lower ore-grades and the closure of a mining plant for maintenance were listed as the reasons behind the decline. Andacollo mine was closed for the month of June, but accounts for only 0.7% of the total copper production in Chile. The monthly drop is comparable to the 2017 fall linked to the extended strike at the largest global copper mine. Mining production, as reflected by INE’s data, is expected to revert in July (2.5% YoY growth during 1H25).

Activity dynamics at the margin remain favorable. Retail sales momentum in the latest quarter was 3.9% QoQ/saar, after the 8.5% in 1Q25 and 9.1% in 4Q24. Manufacturing rose 0.9% QoQ/saar (+2.3% in 1Q25). Despite the June monthly decline, mining momentum during 2Q came in at 6.9% QoQ/saar (-9% in 1Q25).

Our Take: Following today’s mining nosedive, we revised our May IMACEC estimate down by 20bps to 3.4% YoY (in line with May), resulting in growth of 3.0% during 2Q (broadly in line with the BCCh’s estimate). We expect GDP growth of 2.6% this year, lifted by recovering mining-related investment and private consumption. With a weakening labor market, and contained credit dynamics, amid anchored inflation expectations, we expect the BCCh to implement two further 25bp rate cuts this year (to 4.25%).