2025/09/01 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

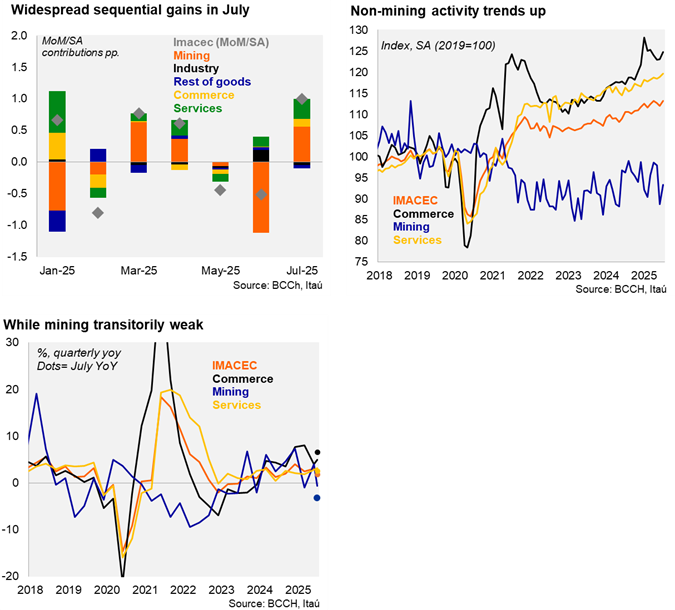

The monthly GDP proxy (IMACEC) increased 1.8% YoY in July (3% in June), essentially in line with the Bloomberg market consensus (1.9%) and somewhat above our call (1.3%). Activity in July rose by 1.0% MoM/SA, boosted by the partial mining rebound (+5.2% MoM/SA, after a 9.5% decline in June). Non-mining activity rose by an upbeat 0.5% MoM/SA (0.7% in June). The positive sequential non-mining dynamics were led by commerce and services. In annual terms, the 3.3% contraction of mining production (-8.9% in June), was offset by commerce (6.6%; lifted by wholesales and well above our estimate) and services (2.6%; business and health related). Overall, if the economy remains flat at the level of the July quarter, 2025 GDP growth would reach 2.4%.

Recent activity momentum has been driven by services. The Chilean economy grew 2.7% YoY in the July quarter (3.1% in 2Q and 2.5% in 1Q25). On a sequential basis, total activity momentum slowed to 0.8% QoQ/SAAR (1.5% in 2Q and 3.5% in 1Q25) but remains in positive territory since the August 2024 quarter. Non-mining sectors grew by a swifter 1.8% QoQ/SAAR (0.4% in 2Q25).

Our Take: Private sentiment evolving in the right direction, lower average inflation, falling interest rates, and a mining-led investment rebound should buoy economic activity. We expect 2025 GDP growth at 2.6% (in line with 2024). Business confidence levels (IMCE) during August approached the neutral threshold (46.7 versus 50 neutral), cementing an improving trend that started in early 2023. Year-to-date imports of capital goods have increased by 25% YoY, with imports up 28% during the first three weeks of August. At the margin there are signs that the worst of the credit slump is behind with commercial loan dynamics showing an improvement. Mining activity will remain downbeat ahead with August flagged by the closure of El Teniente operations. We preliminarily expect IMACEC growth of 1.5% in August. The upbeat non-mining activity dynamics along with elevated real wage growth and upside core inflation surprises over the last few months consolidate our expectation that the central bank will keep the policy rate on hold at 4.75% later this month. We expect one 25bp cut during 4Q25 to 4.5%, with the timing reduced to tactical factors, both globally and domestically.