2025/09/30 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

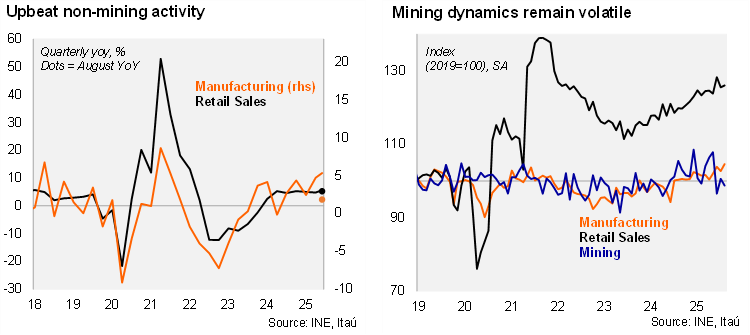

Activity indicators in August came in mixed, with mining expectedly underperforming due to a major incident at a key mine. Real retail sales rose by 5.3% YoY (5.7% in July), essentially in line with the Bloomberg market consensus (5.4%) and somewhat below our call (6.0%). Sequentially, retail sales increased by 0.4% MoM/SA. Manufacturing rose by 1.8% YoY, compared to the Bloomberg market consensus of 1.1% and our call of 2.0%, while posting a sequential increase of 1.9% MoM/SA. Manufacturing was primarily pulled up by food processing (+13% YoY; 4pp contribution), due to an increase in the production of frozen salmon and trout fillets amid greater external demand. Mining contracted for a third consecutive month (-6.3% YoY). Overall, industrial production posted a 1.9% YoY decline (+1.1% in July). Our IMACEC estimate for August, to be published tomorrow, is a below consensus 1.5% YoY (EEE: 1.9%; Bloomberg: 2.0%).

While activity data has been volatile, non-mining momentum is favorable. Retail sales rose by 7.6% QoQ/saar in the rolling quarter ending in August, after the 4.5% in 2Q25 and 8.2% in 1Q24. Manufacturing rose 9.7% QoQ/saar (+1.5% in 2Q25). Mining contracted by a whopping 25% QoQ/saar (+9% in 2Q25), the sharpest sequential decline since early 2017.

Our take: Excluding the volatile mining component, activity dynamics remain upbeat. Growth this year will be supported by resilient private consumption amid elevated real wage growth, along with the mining-led investment recovery. Supply shocks to mining limit our growth call to 2.5% growth call for the year. Our IMACEC estimate for August, to be published tomorrow, is a below consensus 1.5% YoY (EEE: 1.9%; Bloomberg: 2.0%).