2025/12/30 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

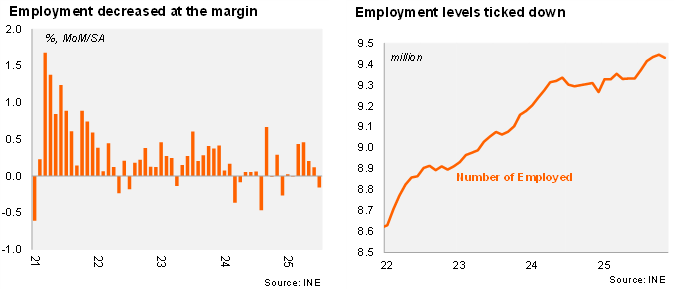

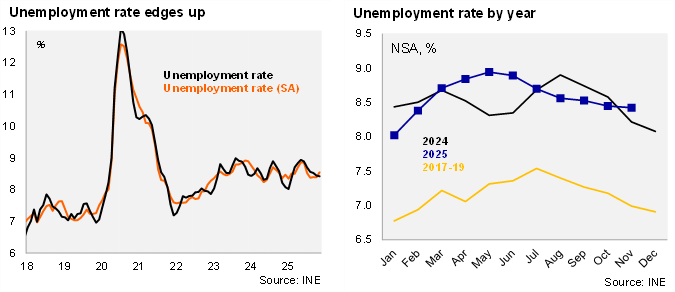

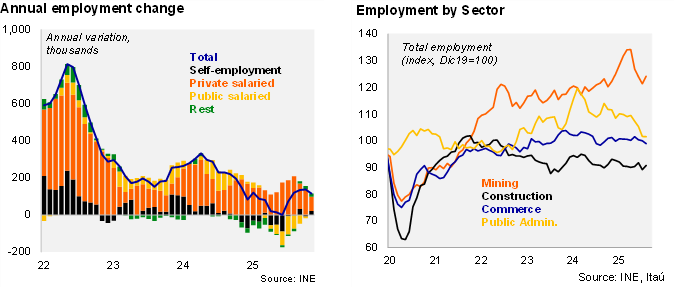

According to the INE’s labor market survey, the unemployment rate rose to 8.4% in the November quarter (8.2% in Nov-24, above the Bloomberg median and our call of 8.2%. Employment rose 1.2% YoY (1.5% in October), corresponding to roughly 115 thousand jobs, lifted mainly by formal posts (+1.7%), while informal ones were flat (+0.03%). Administrative services, transportation and information were key job creating sectors over twelve months, while industry and public administration retreated. The labor force increased by 1.5% YoY (1.3% in October). Labor market informality sits at 26.6%, down 0.03pp over one year. On a seasonally adjusted basis (SA), employment fell by 0.2% MoM/SA, the first negative result since June this year (+0.1% in October). As a result, the seasonally adjusted unemployment rate rose to 8.6%, from 8.4% in the previous three prints, the highest since the April-June quarter (8.9%).

Our take: Slowing job creation suggests the labor market recovery may take some time, as slack should persist. Since May, INE’s unemployment rate consistently surprised market forecasts to the downside, falling towards the ceiling of NAIRU estimates, leading to the view that the deterioration of the labor had finally stalled. We believe the BCCh’s communication also recognized this improvement at the margin. However, November data was somewhat weaker than expected, with slowing job creation a sign of concern, as labor demand proxies remain well below pre-covid levels. Complementary administrative data points to sizable job destruction. According to the Pension Superintendence, the number of unemployment insurance (UI) beneficiaries reached 308,358 in October, up by roughly 24% YoY (4.9% in the rolling quarter). UI beneficiaries had not exceeded 300k since September 2021, when the economy was exiting covid-related mobility restrictions. Consistently, administrative data on layoffs in recent months have risen at a strong clip (7.7% YoY in the rolling quarter ending in October). We maintain our view of relative slack in the labor market, following measures that significantly raised the cost of labor in recent years. The minimum wage is set to increase by 1.9% in nominal terms in January 2026, completing a 54% nominal rise since April 2022; the next minimum wage negotiation should take place in May 2026. The Boric administration is scheduled to present a bill that allows for collective bargaining at the sector level in January, which is likely to face resistance in Congress. We expect an average unemployment rate of 8.5% this year (in line with 2024), and consistent with the ceiling of the BCCh’s NAIRU range estimate (7.5-8.5%). However, if the business sentiment recovery consolidates, and non-mining investment picks up (especially in the construction sector), employment dynamics may gradually improve. The Central Bank’s Business Perception Report (November) signaled limited appetite from firms to expand payrolls over the next year. The INE is scheduled to publish labor market survey data for the quarter ending in December by the end of January.