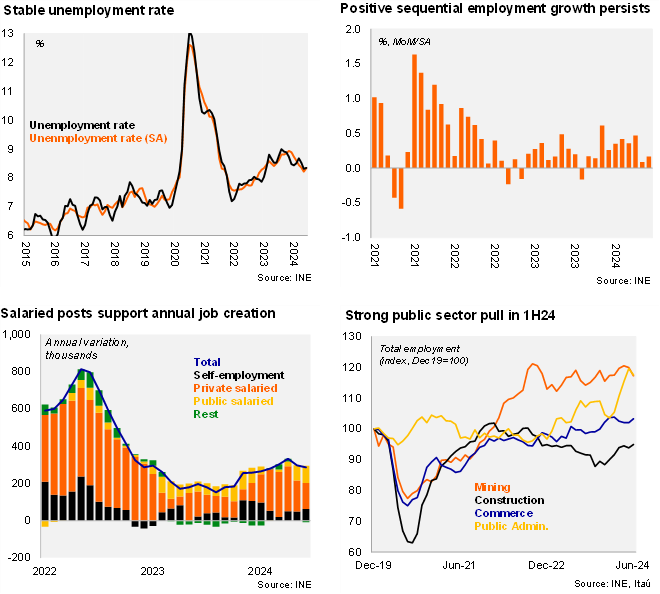

According to the INE’s labor market survey, the unemployment rate for the second quarter of the year came in at 8.3%, in line with the Bloomberg consensus and our call. The unemployment rate implies a 0.2pp fall over twelve months, despite the participation rate increasing 1.2pp (to 62.1%). Employment increased 3.2% YoY (3.4% in 1Q24), boosted by commerce, public administration, and education. The labor force rose 3.0% YoY (3.2% in 1Q24). At the margin, employment rose by +0.2% MoM (SA; the tenth consecutive sequential increase), but the seasonally adjusted unemployment rate ticked up 0.1pp from the previous rolling-quarter to 8.3% (yet still well below the 8.9% cycle peak in the November quarter; 8.4% in 1Q24). Overall, INE’s survey-based reading of the labor market points to a gradual recovery. However, complementary information such as unemployment insurance beneficiaries (reaching highs not seen since September 2021) and layoffs based on firms’ needs (up 10.5% YoY year-to-date as of May) pose challenges to a sustained improvement in formal labor market dynamics over the short-term, as labor demand remains well below pre-covid levels. Altogether, we expect an average unemployment rate of 8.6% during 2024 (8.7% in 2023), but risks tilt to a lower print due to data through the first semester.

Public posts continue to be the main driver behind annual gains. The 3.2% YoY increase in total employment for the quarter ending in June was supported by formal salaried posts (+3.6%; 3.4% in 1Q24), with public jobs rising 8.2% and private posts up 2.5%. Self-employment picked up 3.3% (1.1% in 1Q24). Viewed by economic sectors, job growth was lifted heavily by public administration and defense (+11% YoY), commerce (3.7) and education (4.2%). Separately, employment in construction posted annual growth in the rolling quarter, yet in levels has improved by roughly 50 thousand posts (of a total of 750 thousand in June) since the cycle low of October 2023. The informality rate was stable at 28.2% (28.3% average during 2018-19), but up by 1.1pp over one year.

Our take: With inflation set to sharply rise in coming months as supply-shocks materialize and interest rates likely enter an on-hold period, activity dynamics are likely to soften, hindering the labor market recovery dynamics. We expect a 25-bp rate cut later today, and then for the Board to adopt a wait-and-see approach as to how the inflation convergence path evolves. An earlier rate cutting cycle by the Fed and softening domestic demand may permit lower domestic inflationary pressures and open the door to a resumption of domestic rate cuts during 2025.

Andrés Pérez M.

Vittorio Peretti

Ignacio Martinez Labra