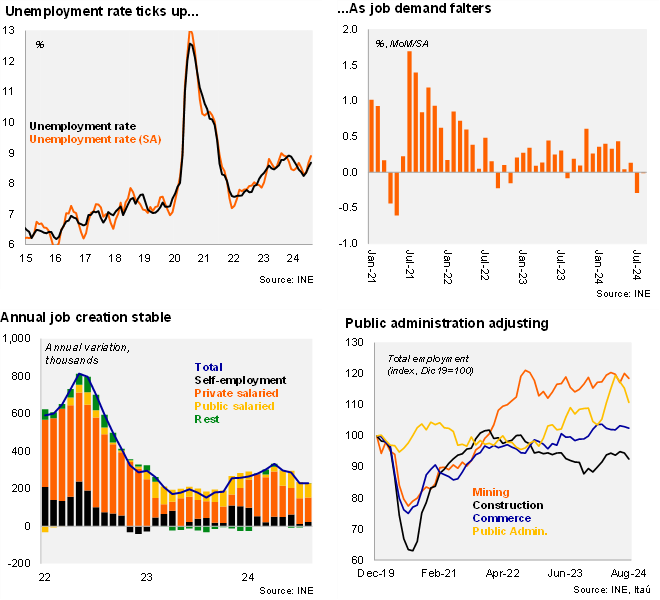

According to the INE’s labor market survey data, the unemployment rate for the quarter ending in August came in at 8.9%, in line with our call yet slightly below market expectations (Blomberg market consensus: 9%). On an annual basis, the unemployment rate fell by 0.1pp (in line with the decline in the previous month), while the participation rate increased by 0.9pp (to 61.8%; +1.3pp during 1H24). Employment rose by 2.5% YoY (3.3% in 1H24), boosted by commerce (4,1% YoY), public administration (3,6% YoY), and education (3,8% YoY). The informality rate reached 27.6% (28.3% average during 2018-19), increasing 0.9pp YoY, pointing to a gradual deterioration of formal job creation throughout the last year. At the margin, employment levels were broadly stable, resulting in the seasonally adjusted unemployment rate rising by 0.2pp from the previous rolling-quarter to 8.7%, the highest level since February 2024 yet still well below the 8.9% cycle peak in the November quarter. Labor demand has weakened; the BCCh’s labor demand proxy for the month of August fell again, by 24.41% YoY (-17.88% in July), remaining well below pre-pandemic levels; at the margin, the index fell to 32.5, from 35.8 in June. Overall, INE’s survey-based labor market dynamics are reflecting some loosening that is likely in response to softer 2Q24 activity dynamics and the implementation of legislation that has raised the cost of labor.

Our take: Signs of a looser labor market, coupled with anchored two-year inflation expectations, weak commercial lending dynamics, and expectations of less hawkish global financial conditions support the central bank's easing stance towards neutral in the coming quarters (with the possibility of eventually settling below neutral levels). We expect an unemployment rate of 8.6% this year (8.7% in 2023).