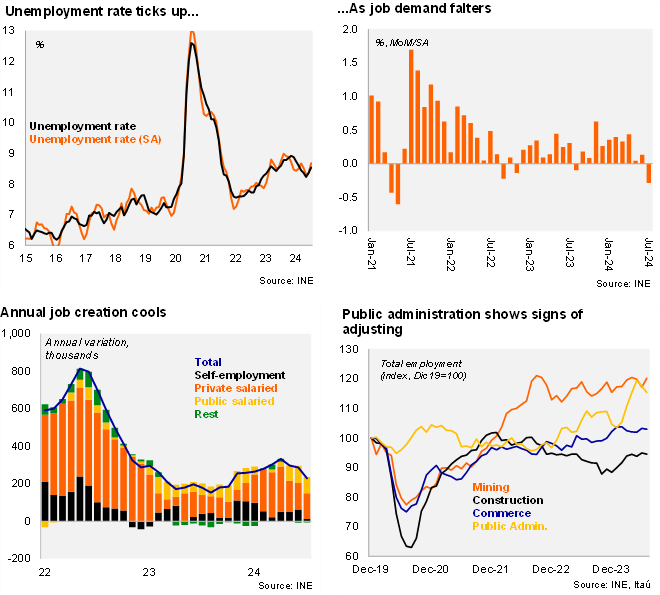

According to the INE, the unemployment rate for the quarter ending in July came in at 8.7%, above both the Blomberg market consensus and our call of 8.5%. The unemployment rate implies a 0.1pp fall over twelve months (-0.2pp in previous months). Also on an annual basis, the participation rate increased 0.9pp (to 61.9%; +1.3pp during 1H24). Employment rose by 2.5% YoY (3.3% in 1H24), boosted by commerce, public administration, and education. Of the 229 thousand jobs created over one year, close to three-fifths were informal. The labor force increased 2.4% YoY (3.1% in 1H24). At the margin, employment fell by 0.3% MoM (SA; the first decline since August 2023), resulting in the seasonally adjusted unemployment rate ticking up 0.1pp from the previous rolling-quarter to 8.5% (yet still well below the 8.9% cycle peak in the November quarter). Overall, INE’s survey-based labor market dynamics are starting to reflect some loosening that has been evident in complementary data, and in line with the activity softening witnessed in 2Q24. Unemployment insurance beneficiaries rose by 10% YoY in June, continuing its upward trend, while layoffs based on firms’ needs were up 6.6% YoY during the first semester. Labor demand proxies have stabilized well below pre-pandemic levels, suggesting job creation is unlikely to pick up materially in the near term. We expect an unemployment rate of 8.6% this year (8.5% in 1H24; 8.7% in 2023).

Public posts continue to be the main driver behind annual gains, while self-employment growth grinds to a halt. The 2.5% YoY increase in total employment was pulled up by formal salaried posts (+3.3%; 3.6% in 2Q24), with public jobs rising 6.9% and private posts up 2.5%. Self-employment rose by a far milder 0.6% (3.3% in 2Q24). Viewed by economic sectors, job growth was lifted heavily by public administration and defense (+5.7% YoY), commerce (3.3%) and education (4%). Separately, construction continued along a gradual recovery path, rising 2.7% YoY. The informality rate ticked down at the margin to 27.6% (28.2% in 2Q; 28.3% average during 2018-19).

Our take: Higher electricity prices should lift inflation in the coming months to end the year in the 4.5%-5% range, denting consumer dynamics and consolidating the downside bias to our 2.5% 2024 GDP growth call. Signs of a loosening labor market, along with anchored two-year inflation expectations, soft commercial loan dynamics and the expectation of less restrictive global financial conditions will support the central bank's strategy of lowering rates over its policy horizon. The INE will publish labor data for the quarter ending in August on September 30.