2025/09/08 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

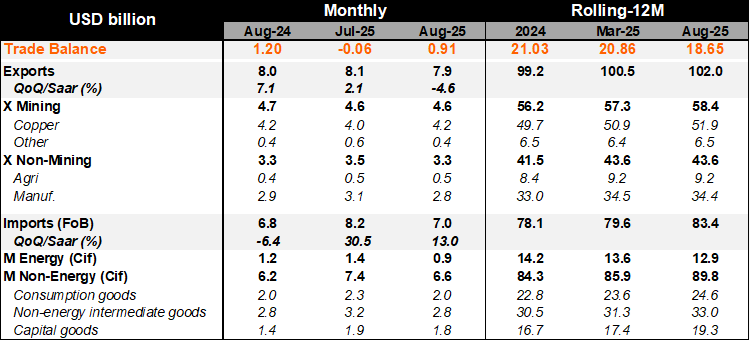

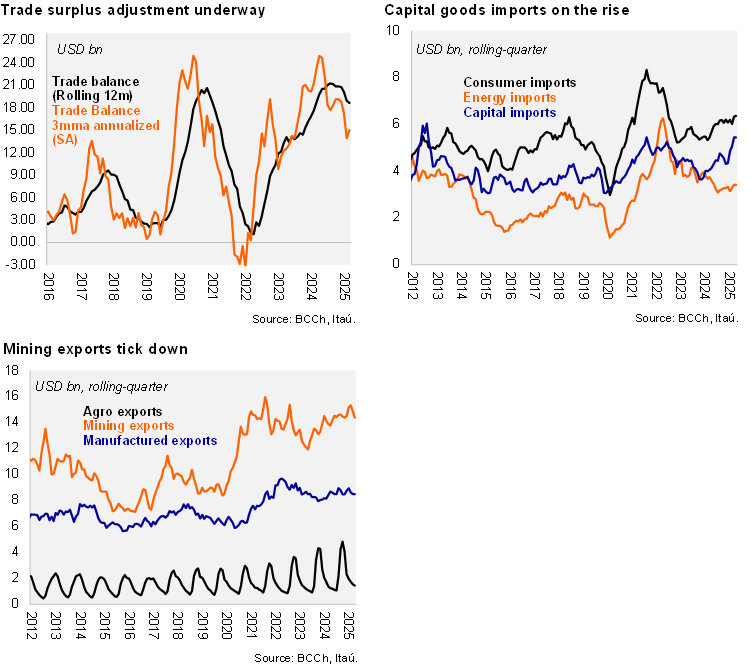

After registering the first trade deficit since late 2022 in July, the trade balance returned to a large surplus of USD 0.9 billion in August (Itaú: USD 1 billion), as import growth slowed. The trade result was below the USD 1.2 billion surplus in August last year. Copper exports fell by 2.2% YoY in August, softening following demand normalization in the US. Recent domestic supply shocks may consolidate weaker dynamics ahead. Manufacturing exports also weakened. Total exports contracted by 1.7% YoY (-0.4% in July). On the import front, capital import growth remained upbeat (27% YoY), while consumer goods increase slowed (1.0% YoY). Energy goods imports were a key drag in the month (-26% YoY). Overall, imports rose by 2.3%, down from 16% in July. The rolling 12-month balance as of August reached USD 18.6 billion (below 6% of GDP), down from the cycle peak of just over USD 21 billion. The annualized quarterly trade balance sits at a lower USD 15 billion (USD 25 billion cycle peak during late 2024). Exports contracted 5% QoQ/SAAR, while imports momentum slowed but remained at an upbeat double-digit pace.

Our Take: We expect the recovering domestic demand scenario amid moderating global demand will lead to a narrower trade surplus this year and a widening of the CAD to 2% of GDP, with risks tilted to the upside (1.5% in 2024). The BCCh will publish September’s trade data on October 7.