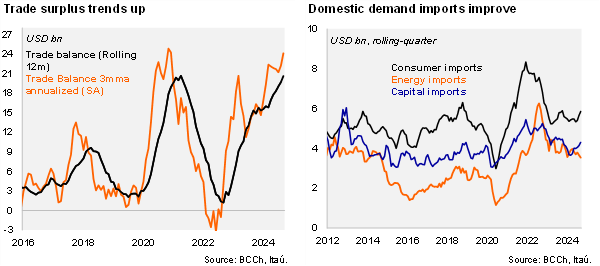

A USD 1.8 billion trade surplus was recorded in September, well above the USD 0.9 billion surplus one year earlier. The surplus came in above our USD 1.4 billion call. The rolling one-year trade balance rose to USD 20.6 billion (above 6% of GDP; USD 15.3 billion in 2023). Meanwhile, the annualized quarterly trade balance sits at an elevated USD 24.1 billion (SA). Exports rose by 8.7% YoY (1.4% in August), as nominal copper exports reached the highest level since the close of 2021, resulting in a 21.1% YoY increase. Lithium exports contracted 46% YoY. Manufacturing exports dropped 2.2% YoY, dragged by food processing and chemicals. Meanwhile, lower global energy prices in the recent past are dragging total imports down (contracting 4.8% YoY; 7.3% down in August). Imports of capital good posted a return to growth 2.7% YoY), the first annual gain in two years, and in line with the view that the bulk of the investment adjustment has unfolded. Consumer goods imports grew 4.3% YoY (7.3% drop in August), pulled up by the durable component.

Signs that the domestic demand slump is gradually unwinding, in line with improving activity dynamics in 3Q. During the third quarter of the year, total imports fell 0.8% (-5.1% in 2Q24), as energy-related goods dropped 7.9% YoY. Capital goods imports shrunk by a milder 3.1% (-12.4% in 2Q), and consumer goods ticked up a moderate 0.8%. Sequentially, imports were flat in the quarter (SA; -8.2% QoQ/Saar in 2Q), but excluding energy goods, imports rose 43% QoQ/Saar. On the other hand, exports are booming. Mining exports grew 13.9% YoY in the quarter, a similar gain to that of 2Q24 despite lithium sales halving over one year as copper exports rose 23.3% (boosted by prices). Manufactured exports were broadly flat over one year. Sequentially, exports grew 10% QoQ/Saar.

Our Take: Risks tilt to an even swifter narrowing of the current account deficit this year. This year’s trade surplus may exceed our USD 21 billion call, and place downward pressure on our CAD call of 2.5% of GDP (3.6% last year). The result rebound in global oil price amid the Middle East conflict may offset some of the gains from stimulus measures in China.