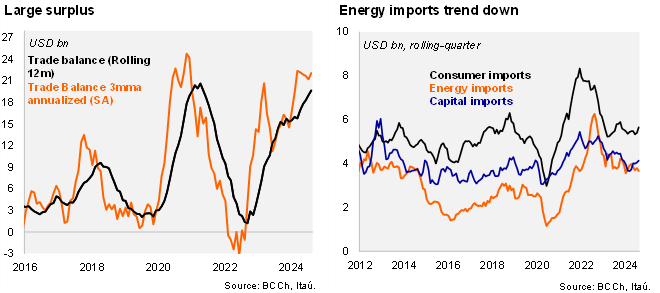

A USD 1.1 billion trade surplus was recorded in August, well above the USD 0.5 billion surplus in August last year. The surplus came in below our USD 1.6 billion call. The rolling one-year trade balance rose to USD 19.7 billion (around 6% of GDP; USD 15.3 billion in 2023). Meanwhile, the annualized quarterly trade balance sits at an elevated USD 22.1 billion (SA). Exports rose by a milder 1.4% YoY (16.2% in July), as copper exports growth slowed, and manufacturing returned to negative ground (as food processing and chemical production declined). Meanwhile, imports contracted 7.3% YoY (after rising 6.8% in July). Imports fell across the board, with consumer imports dropping 7.3% YoY, energy imports down 9.9% and capital goods falling 10.8%. Imports of mining and construction machinery were broadly flat over the last year at a low level.

Imports yet to consolidate a sustained improvement. During the rolling-quarter, consumer goods imports dropped 3.6% (5.1% fall in 2Q24), as consumer goods imports dropped 2.4% YoY (1.5% fall in 2Q), energy imports dipped 2.8% (2.4% decline in 2Q), and capital goods imports shrunk at 8.2% (-12.4% in 2Q). Sequentially, imports rose by a moderate 0.3% QoQ/Saar (SA; -8% in 2Q). On the other hand, exports are showing signs of softening. Mining exports grew 9.6% YoY in the quarter, down from 13.7% in 2Q. Lithium shrunk by 54%, the copper pull eased (18.8% versus 22% in 2Q). Manufactured exports 1.7% YoY. Sequentially, exports grew 1% QoQ/Saar.

Our Take: The current account deficit will narrow further this year amid soft domestic demand and favorable terms of trade. We expect a 2.7% current account deficit in 2024, down from 3.6% last year and 8.6% in 2022. While we see risks tilt to an even swifter narrowing of the CAD, faltering growth in China may offset this from materializing.