2025/11/07 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

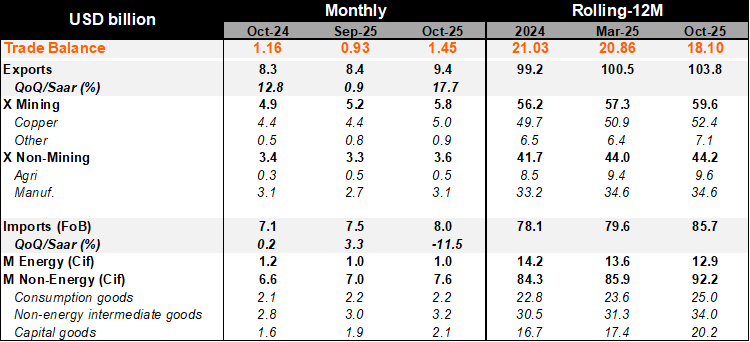

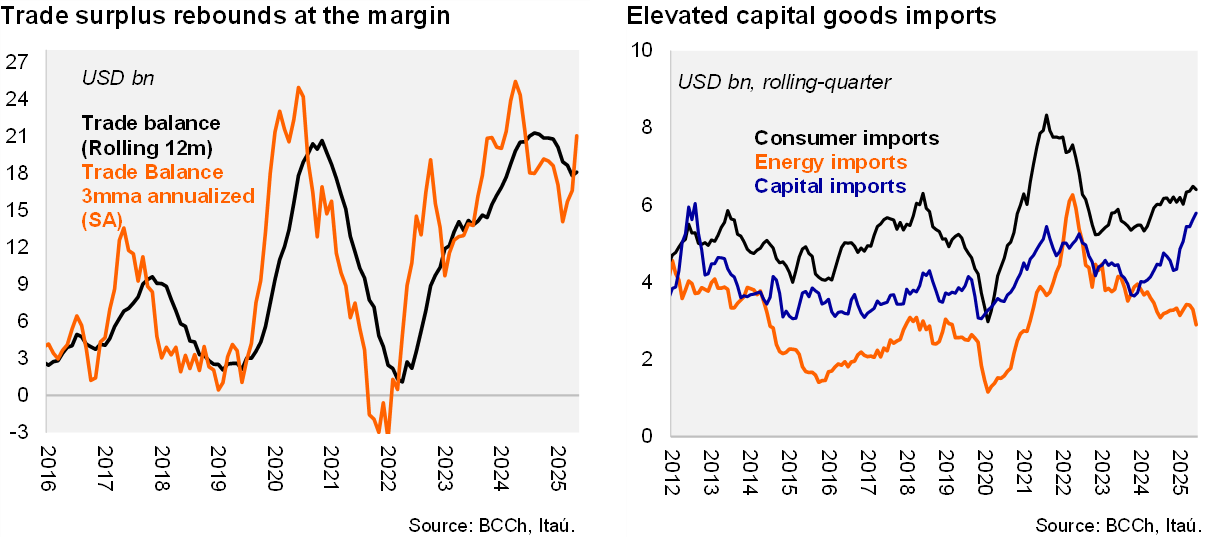

A trade surplus of USD 1.45 billion was recorded in October, above the Bloomberg market consensus of USD 1.1 billion, while in line with our call (USD 1.3 billion). As a result, the rolling-12m trade balance reached USD 18.1 billion, ticking up from a recent dip (USD 21 billion in 2024). The annualized quarterly trade balance sits at a lower USD 21 billion (USD 25 billion cycle peak during late 2024). Exports grew 14% year-on-year, boosted by the 19% mining gain. On the import side, total imports increased by 12% YoY, with capital goods posting a notable gain of 30% YoY, boosted at the margin by energy related equipment, and overall in line with the investment-led recovery underway. Consumer goods imports were up 5%, while energy goods imports contracted by double-digits. Sequentially, exports increased 18% QoQ/SAAR, while imports fell by 12% QoQ/SAAR.

Our Take: The recovery of domestic demand amid elevated but stable exports will lead to a gradual narrowing of the trade surplus. We expect a CAD of 3% of GDP this year (1.5% in 2024), although risks tilt to a smaller deficit given recent trade dynamics. The BCCh will publish November’s trade data on December 9.