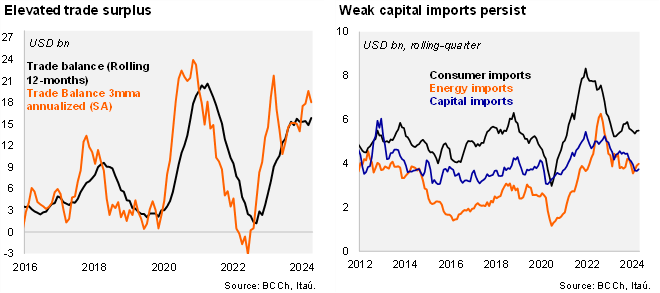

A trade surplus of USD 1.9 billion was registered in April, a tick above the Bloomberg consensus and our call, both at USD 1.7 billion. The April surplus was far greater than the print in April last year (USD 0.9 billion). As a result, the rolling one-year trade balance rose to USD 15.9 billion (USD 15.3 billion in 2023). The annualized quarterly trade balance sits at USD 18 billion (SA). Total exports increased by 15% YoY, driven by rising copper sales (+25.3% yoy) as the upbeat mining activity start to the year combined with higher prices support exports. On the other hand, imports rose by a mild 1.6% YoY, lifted by consumer goods imports (+4.9%), while the capital imports drag persists (-11.9%; reflecting still weak investment dynamics).

Despite recovering consumer goods imports, upbeat copper sales and still weak capital imports support large trade surpluses. Mining exports increased by 21.2% YoY during April, with copper up 25.3% (4.2% in 1Q24). Lithium exports continue to correct from prior highs (-22% during April; -45% in 1Q24). Manufactured exports increased 3.9% YoY, the first positive print since October-23. On the import front, non-durable consumer goods imports posted a 6.9% YoY increase (8% in 1Q24), the key drivers behind total consumer goods imports (+4.9%). Durable imports increased by a mild 1.2% (-1.2% in 1Q24). Import dynamics are dampened by the double-digit capital imports decline (-11.9%; -12.2% in 1Q24), dragged by trucks (-26%), mining and construction equipment (-42.1%), and electrical equipment (-4.8%). Energy imports rose 11.1% YoY, in line with higher international oil prices during the month. Sequentially, exports grew 7.1% QoQ/Saar (+24% in 1Q24) while total imports increased 5.9% QoQ/Saar (-2.8% in 1Q4).

Our take: Robust copper exports at the start of the year are in line with recovering production as evidenced by the monthly GDP proxy Imacec. The consumer goods led import recovery is consistent with our expectation that private consumption will gradually improve in the coming quarters, aided by growth in the real wage bill, lower inflation and less contractionary interest rates. The large trade surpluses seen so far this year place a downside bias to our CAD call of 3.8% of GDP (3.6% in 2023).