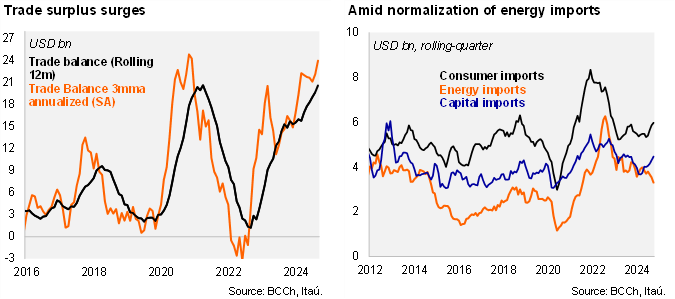

A USD 1.4 billion trade surplus was recorded in October, well above the USD 0.7 billion surplus one year earlier. The surplus came in below our USD 1.6 billion call. The rolling one-year trade balance rose to USD 21.4 billion (edging closer to 7% of GDP; USD 15.3 billion in 2023). Meanwhile, the annualized quarterly trade balance sits at an elevated USD 25.8 billion (SA). Exports rose by 10.1% YoY (8.7% in September), as nominal copper exports reached the highest level since the close of 2021, resulting in a 25.9% YoY increase. Lithium exports contracted 64% YoY (due to lower prices, a key factor behind underwhelming fiscal revenue). Manufacturing exports rose 2.5% YoY, lifted by food, pulp and paper while chemical sales fell. Meanwhile, lower energy-related imports (-27.2% YoY) are a drag on imports. Nevertheless, both imports of consumer and capital goods increased from last year. Total imports rose by 0.6% YoY (4.8% drop in September), as machinery and equipment lifted capital goods by 9.6% YoY (+2.7% in September), a signal that the worst of the investment correction is behind the Chilean economy. Total consumer imports rose by 87.1% YoY (4.3% previously), boosted by a double-digit gain in durables goods.

Improving domestic demand signals. Total imports fell 3.9% in the October rolling-quarter (-5.1% in 2Q24), as energy-related goods dropped 22% YoY. More upbeat news came from recovering capital goods that grew in the quarter (+0.1% YoY) for the first time in two years, lifted by the 10% rise in imports of mining and construction machinery and equipment. Consumer goods ticked up 1.2% YoY (1.5% drop in 2Q). Sequentially, imports dropped 10% in the quarter (SA; -9% QoQ/Saar in 2Q), but excluding energy goods, imports rose 16% QoQ/Saar. On the other hand, exports continue to evolve favorably. Mining exports grew 12.1% YoY in the quarter, a similar gain to that of 2Q24 despite lithium sales plummeting. Agricultural exports are growing at a double-digit rate, while manufactured exports edged down 2.6% YoY. Sequentially, exports grew 11% QoQ/Saar.

Our Take: The trade surplus this year will likely exceed our USD 21 billion call and lead to an even narrower CAD than the 2.5% of GDP we have, reducing the vulnerability to global shocks that may arise ahead given geopolitical risks and a potential return to a trade war.