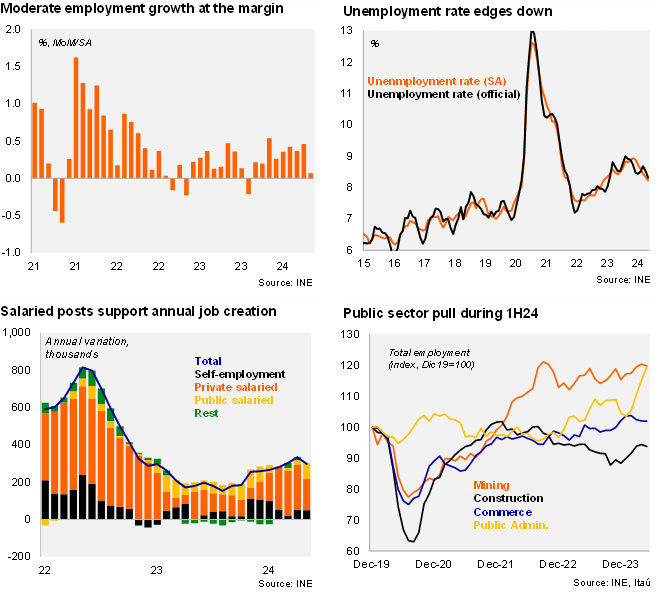

The unemployment rate for the quarter ending in May fell to 8.3%, below the BBG consensus and our call of 8.5%. The unemployment rate implies a 0.2pp fall over twelve months, while the participation rate increased 1.3pp (to 62.2%, the highest since March 2020). Employment increased 3.3% YoY (3.7% in April), whereas the labor force rose 3.1% (3.5% in April). Employment growth on an annual basis was boosted by the informal sector, rising 6.4%, while the formal sector increased 2.1%. At the margin, employment rose by +0.1% MoM variation (SA; +0.3% on April), taking the seasonally adjusted unemployment rate to 8.2% (8.3% in April; 9% cycle peak in the November quarter). Overall, INE’s survey-based labor market dynamics points to a gradual recovery. However, complementary information such as unemployment insurance beneficiaries and layoffs based on firms’ needs (increasing annually by 29% and 18% respectively in April), pose challenges to a sustained improvement in formal labor market dynamics over the short-term.

Public posts continue to be the main driver behind annual gains. The 3.3% YoY increase in total employment was pulled up by salaried posts increasing 3.8% YoY (4.1% in April). Public salaried jobs rose a staggering 7% (2.1% in April), while private posts were up 3.1% (4.5% in April). Self-employment increased at a steady 2.6%. Viewed by economic sectors, job growth was lifted heavily by public administration and defense (+17% YoY), whereas transport also contributed with an annual gain of +5.3%. Separately, construction posted a 0.8% contraction, in line with the disparity seen in performance among the different economic sectors. The informality rate was stable at 28.2% (28.3% average during 2018-19), but up by 0.8pp over one year, adding more doubts about the strength of the total employment dynamics.

Our take: Despite positive dynamics in INE’s survey data, we believe the labor market still has some slack. We expect an unemployment rate to average 8.6% this year. down 0.1pp from 2023. The greater risks to inflation and monetary policy in the near term come from the supply-side, related to the upcoming electricity price adjustments (adding upside risks to our year-end inflation call of 4.1% and 3.1% for this year and the next). With medium-term inflation expectations still anchored, we expect the BCCh to advance with a pair of 25bps cuts before pausing the cycle at 5.25%.