Since late February, copper underwent a section 232 investigation to determine whether imports represent a national security risk to the USA, which led to a 50% specific tariff announcement on copper imports on July 8. Today, the White House formally announced important exceptions to the 50% tariff on copper imports, which comes into effect on August 1. The tariff excludes copper input material such as copper ores, concentrates, cathodes and anodes (which concentrate almost the total of Chile's copper exports to the US). The 50% tariff will apply to semi-finished copper products (pipes, rods etc., more relevant for Mexico, Canada, China).

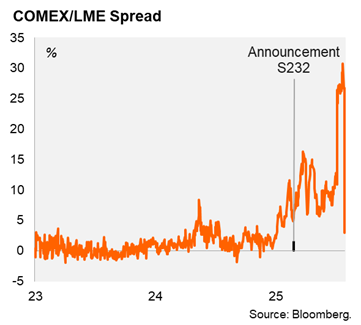

The US Comex market had incorporated a spread with the ex-US prices (LME) that will likely recede following the tariff update.

The USA represents around 6% of global refined copper consumption with imports accounting for around half of total copper consumption (Chile supplying around 70%). Chile exports mostly refined copper to the USA. In 2024, the U.S. imported USD 4.6 billion in refined copper from Chile and no copper ore. Chilean copper shipments to the U.S. more than doubled in early 2025, largely due to anticipated tariffs, with Codelco and other major producers redirecting refined copper exports from Asia to North America. With copper demand inelastic, the initially proposed tariff would have resulted in higher production costs in the USA before domestic supply gains kicked in. We previously signaled that with market estimated price elasticities of demand (Steurmer 2017, Agostini 2006), and considering the volume of copper exports to the USA, US demand could have declined by 15% to 20% over the next 5 to 10 under a 50% tariff scenario.

The global supply-demand copper scenario remains tight, sustaining copper prices at elevated levels that should support CLP dynamics and consolidate upbeat investment dynamics going forward. We expect Chile to reach a trade surplus in goods of around 6% of GDP this year, and a contained CAD of 2% of GDP (1.5% in 2024). Separately, Chile’s 10% “Liberation day” tariff has yet to be confirmed, with an announcement expected by August 1.

----

References

Stuermer, Martin, 2017. "Industrialization and the demand for mineral commodities," Journal of International Money and Finance, Elsevier, vol. 76(C), pages 16-27.

Agostini, Claudio, 2006. “Estimating Market Power in the US Copper Industry.” Review of Industrial Organization 28, no. 1 (2006): 17–39.