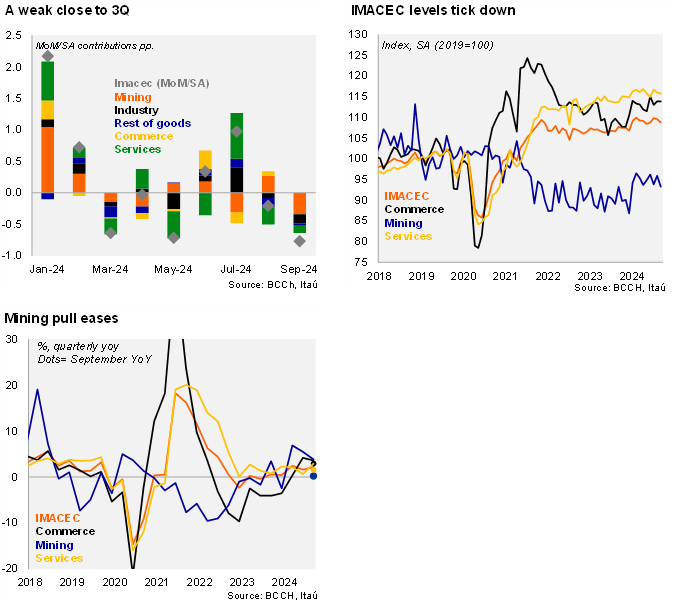

According to the Central Bank, the Monthly Index of Economic Activity (IMACEC) contracted sequentially for the second consecutive month, with widespread sectoral declines. Total activity dropped 0.8% from August to September, resulting in a null annual variation (2.3% YoY in August). Stable activity levels on an annual basis underwhelmed market expectations with the Bloomberg consensus at 1.2%, the central bank’s analyst survey of 1.7% and our 1.1% call. September had one less working day than last year. On an annual basis, the lower value-added electricity generation was a key drag (resulting in other goods dropping 4.5% YoY). The mining pull eased (0.2%; 8% in August). Commerce grew at a steady 2.9% annual pace, while services were up 1.6% (1.9% in August). Non-mining activity increased a mild 0.3% YoY (1.5% in August). In seasonally adjusted terms, the 0.8% MoM/SA IMACEC fall was dragged by the 2.8% mining drop. Manufacturing fell 1.6% MoM/SA declining manufacturing. Services ticked down 0.2% from August mainly due to business services. Non-mining activity (SA) dropped 0.5%, in line with the previous month’s decline. During the first three quarters of the year, the Chilean economy has grown 2.1% YoY (0.2% during the equivalent 2023 period). If the economy maintains the September level towards the end of the year, GDP will expand by roughly 2.0% YoY (0.6% in 2023).

Activity in 3Q picked up from the second quarter. IMACEC rose by 2.1% YoY in 3Q24, above the 1.6% in 2Q24, and in line with the central bank’s IPoM’s estimate. Non-mining rose by 2.1% (1% in 2Q). At the margin, activity increased 2.3% qoq/saar, after the 2.3% decline in 2Q. Manufacturing and commercial activity drove sequential dynamics with a 12.7% and 2.6% qoq/saar increase, respectively. Services rose by 1.1% (1.7% drop in 2Q), while mining was down 2.4%.

Investment signals remain weak. Business sentiment remains downbeat, commercial credit dynamics have yet to improve, and international developments have dampened the global outlook. The banking system’s stock of outstanding real loans in Chile fell in September by 2.64% YoY, after declining by 2.04% in August (-2.65% in September 2023). Outstanding real commercial loans in Chile fell further in September by 5.85% YoY, after plummeting in August by 4.45% (-5.65% in September 2023), declining on an annual basis since May 2022. The cumulative fiscal deficit rose higher in September to 2.5% of GDP, exceeding the MoF’s 2.0% year-end nominal deficit forecast and last year’s annual deficit (2.4%). Non-mining business confidence as measured by the IMCE came in at 43.2 in October (50 = neutral), still low but the highest level this year.

Our Take: The data is more volatile than usual. The surprise in September could be partly due to the unusually long Fiestas Patrias holiday, while the others in the year might have been caused by the effects of climate shocks. Reaching our 2.5% GDP growth call will require a string end to the year. The economy would need to grow by around 3.6% year-on-year in 4Q24, consistent with a quarterly expansion of 1%. The recovery of the economy this year, seen from the demand side, will continue to come from private consumption, while private investment remains weak. The BCCh will release the national accounts for the third quarter on November 18, and the IMACEC for October on December 2.